Study Notes

Overview

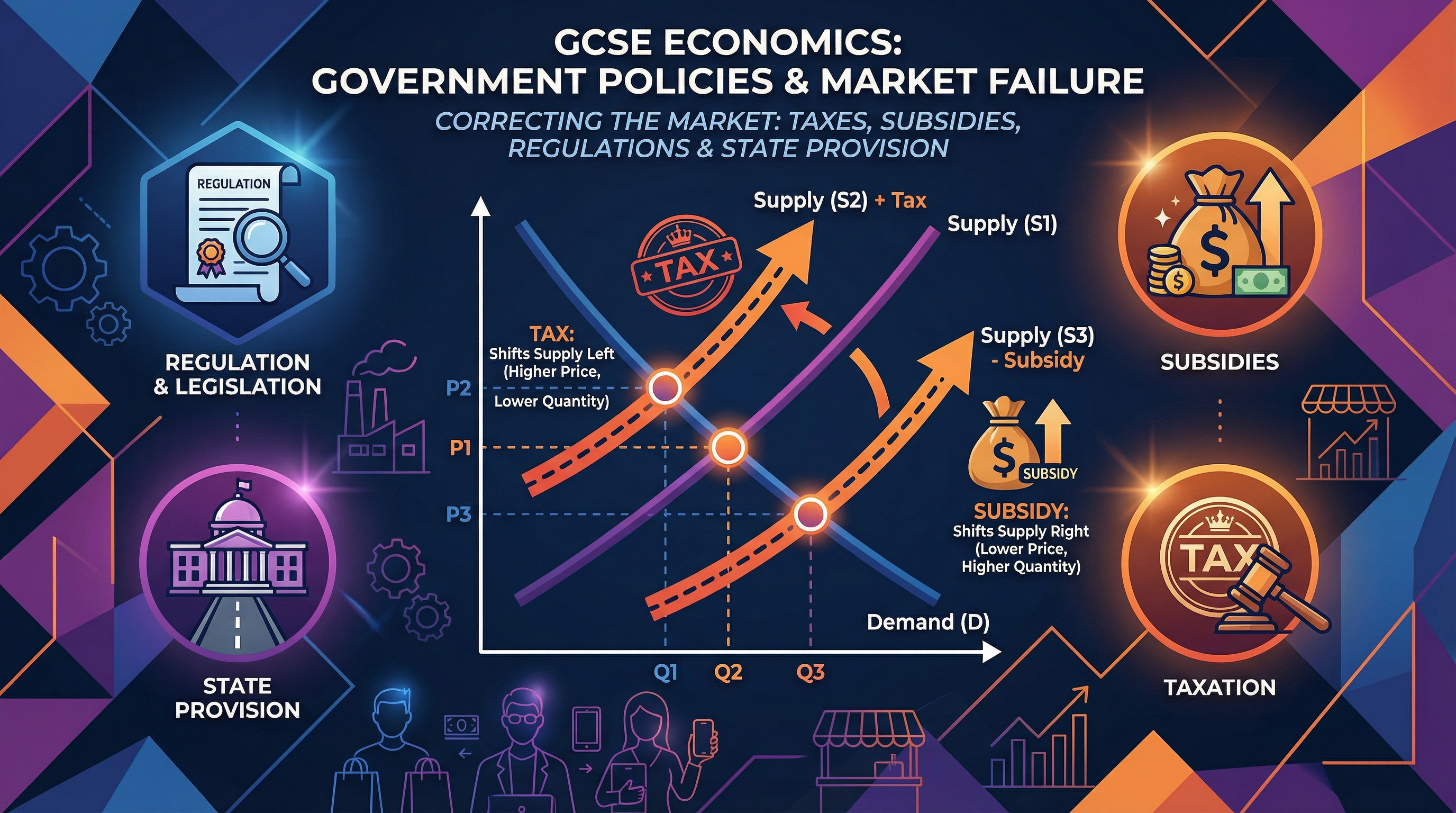

This study guide focuses on a core component of the OCR GCSE Economics (J205) specification: government intervention to correct market failure. Candidates are expected to understand why markets fail and analyse the mechanisms governments use to intervene, such as indirect taxes, subsidies, regulation, and state provision. A crucial part of this topic is the ability to use supply and demand diagrams to illustrate the impact of these policies and to evaluate their effectiveness, considering concepts like price elasticity of demand, opportunity cost, and potential government failure. Examiners award high marks for responses that apply theoretical knowledge to specific real-world contexts and provide a balanced evaluation of the unintended consequences of intervention.

Key Government Interventions

1. Indirect Taxes

What they are: Taxes imposed on goods and services, which increase the costs of production for firms. Examples include Value Added Tax (VAT), fuel duty, and taxes on cigarettes and alcohol.

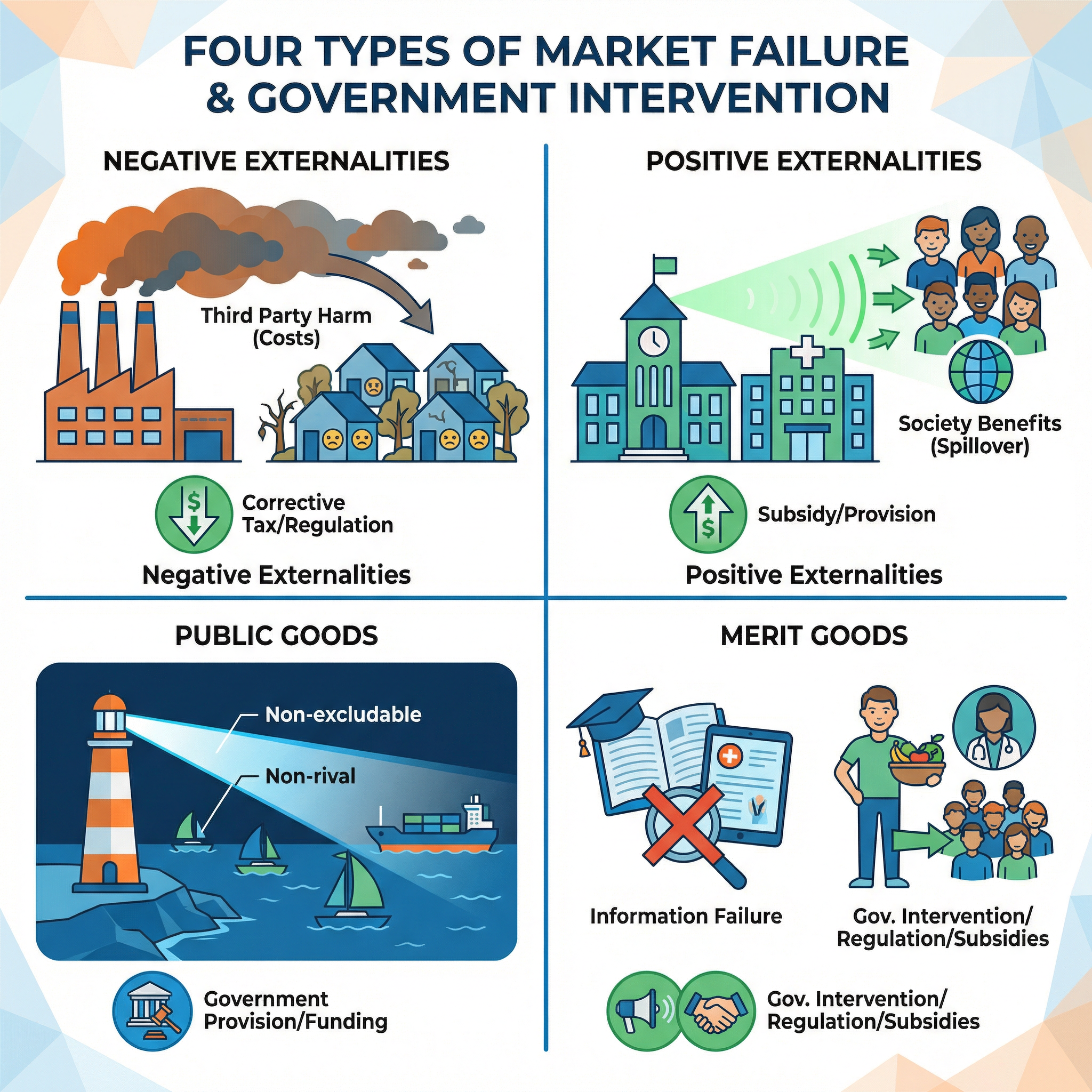

Why they are used: To correct for negative externalities (e.g., pollution from cars, health issues from smoking) by making the good or service more expensive, thereby reducing demand and moving consumption closer to the socially optimal level.

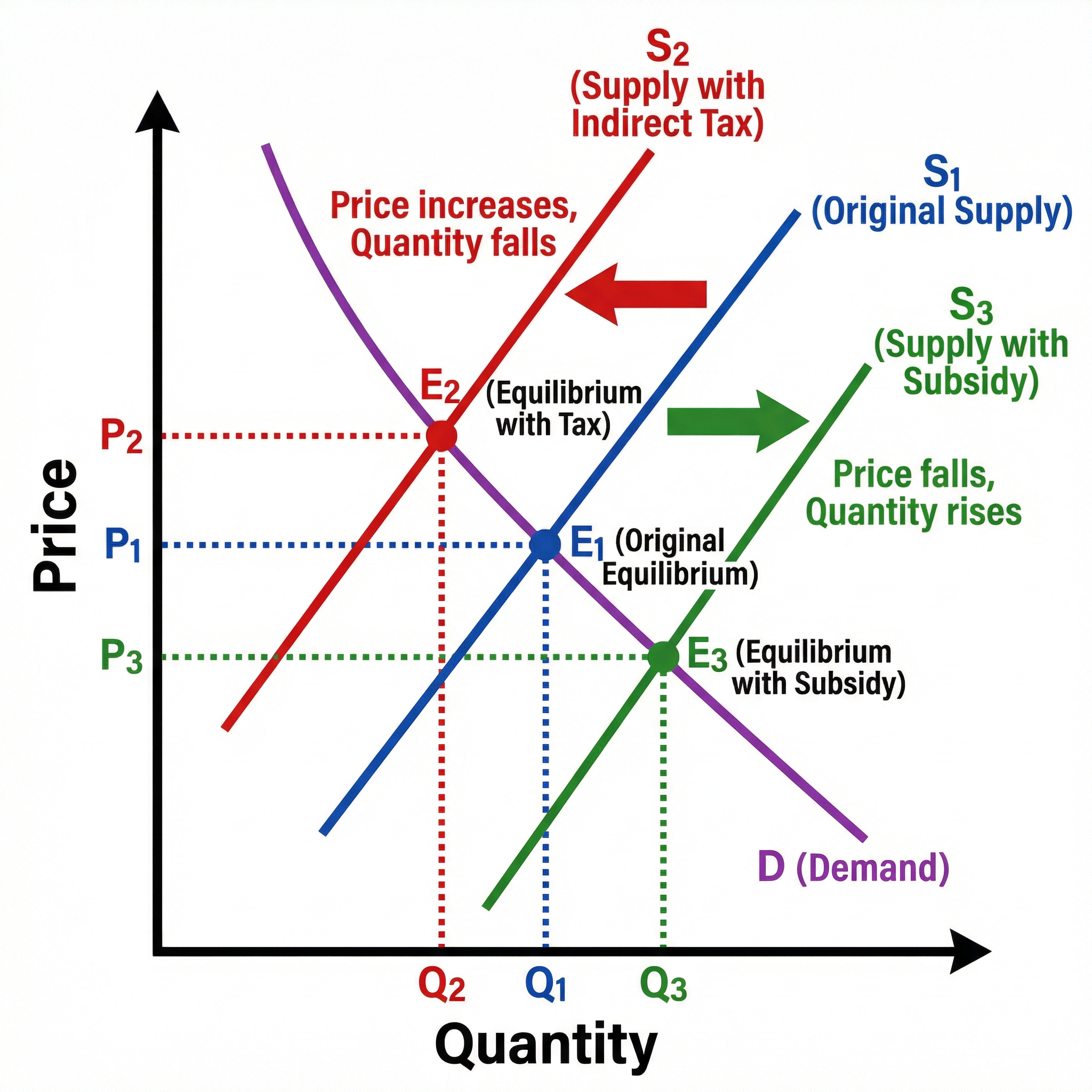

Diagrammatic Analysis: An indirect tax shifts the supply curve to the left (from S1 to S2). This leads to a higher price (P1 to P2) and a lower quantity traded (Q1 to Q2). The vertical distance between the two supply curves represents the amount of the tax per unit.

Specific Knowledge: Candidates should be able to reference specific examples, such as the UK Sugar Tax, and discuss its aims and outcomes.

2. Subsidies

What they are: Payments made by the government to producers to lower their costs of production and encourage them to produce more of a certain good or service. Examples include subsidies for renewable energy, public transport, and apprenticeships.

Why they are used: To correct for positive externalities (e.g., the social benefits of education or renewable energy) by making the good or service cheaper, thereby increasing consumption towards the socially optimal level.

Diagrammatic Analysis: A subsidy shifts the supply curve to the right (from S1 to S3). This leads to a lower price (P1 to P3) and a higher quantity traded (Q1 to Q3). The vertical distance between the two supply curves represents the amount of the subsidy per unit.

3. Regulation & Legislation

What it is: Rules and laws created by the government to control the behaviour of producers and consumers. Examples include banning smoking in public places, setting maximum pollution levels for factories, and making education compulsory up to the age of 18.

Why it is used: To directly prohibit or limit activities that cause negative externalities or to compel activities that have positive externalities. It is often used when the government wants to send a clear signal that a certain activity is socially unacceptable.

Evaluation: While regulation can be very effective at changing behaviour quickly, it can be expensive to monitor and enforce. Firms may also find loopholes, and the penalties for non-compliance may not be a sufficient deterrent.

4. State Provision

What it is: The government directly provides certain goods and services, funded through taxation. This is most common for public goods.

Why it is used: To provide public goods that the free market would not provide at all due to the 'free-rider problem'. Public goods are non-excludable (you can't stop anyone from benefiting) and non-rival (one person's use doesn't prevent others from using it). Examples include national defence, street lighting, and flood defences.

Second-Order Concepts

Causation

Government intervention is caused by the existence of market failure. The specific type of market failure (e.g., negative externalities, public goods) determines the type of intervention chosen.

Consequence

The immediate consequence of a tax is a higher price and lower quantity. The long-term consequence could be a change in consumer behaviour, a decline in an industry, or government failure if the tax is set at the wrong level. For subsidies, the immediate consequence is a lower price and higher quantity, with long-term consequences including increased innovation in a sector or a long-term dependency on government support.

Significance

The significance of government intervention is that it can improve the allocation of resources and increase overall social welfare. However, it can also lead to unintended consequences, such as the creation of black markets, high costs for taxpayers, and government failure, where the intervention leads to a worse outcome than the original market failure.

Source Skills

When presented with a source (e.g., a news article about a new tax), candidates should analyse it by considering:

- Content: What does the source say about the policy's impact on price, quantity, and different stakeholders (consumers, producers, government)?

- Provenance: Who created the source and why? Is there potential for bias? (e.g., an industry group complaining about a new regulation).

- Limitations: What information is missing? Does the source show a short-term or long-term view?