Study Notes

Overview

Choosing the right form of business ownership is one of the most important decisions an entrepreneur will make. For the AQA GCSE Business exam, candidates must be able to not only describe the features of the four main types of business ownership but also to analyse and evaluate their suitability in different scenarios. This study guide will equip you with the knowledge and skills to confidently tackle questions on sole traders, partnerships, private limited companies (Ltds), and public limited companies (PLCs). Examiners are looking for a clear understanding of the trade-offs involved, particularly concerning liability, control, and the ability to raise finance. Credit is awarded for applying this knowledge to the specific context of the business presented in the exam paper, demonstrating a clear chain of reasoning that links a feature of ownership to a specific consequence for the business.

Key Ownership Structures

Sole Trader

What it is: A business owned and controlled by one person. It is the most common form of business structure in the UK due to its simplicity. The owner and the business are legally the same entity.

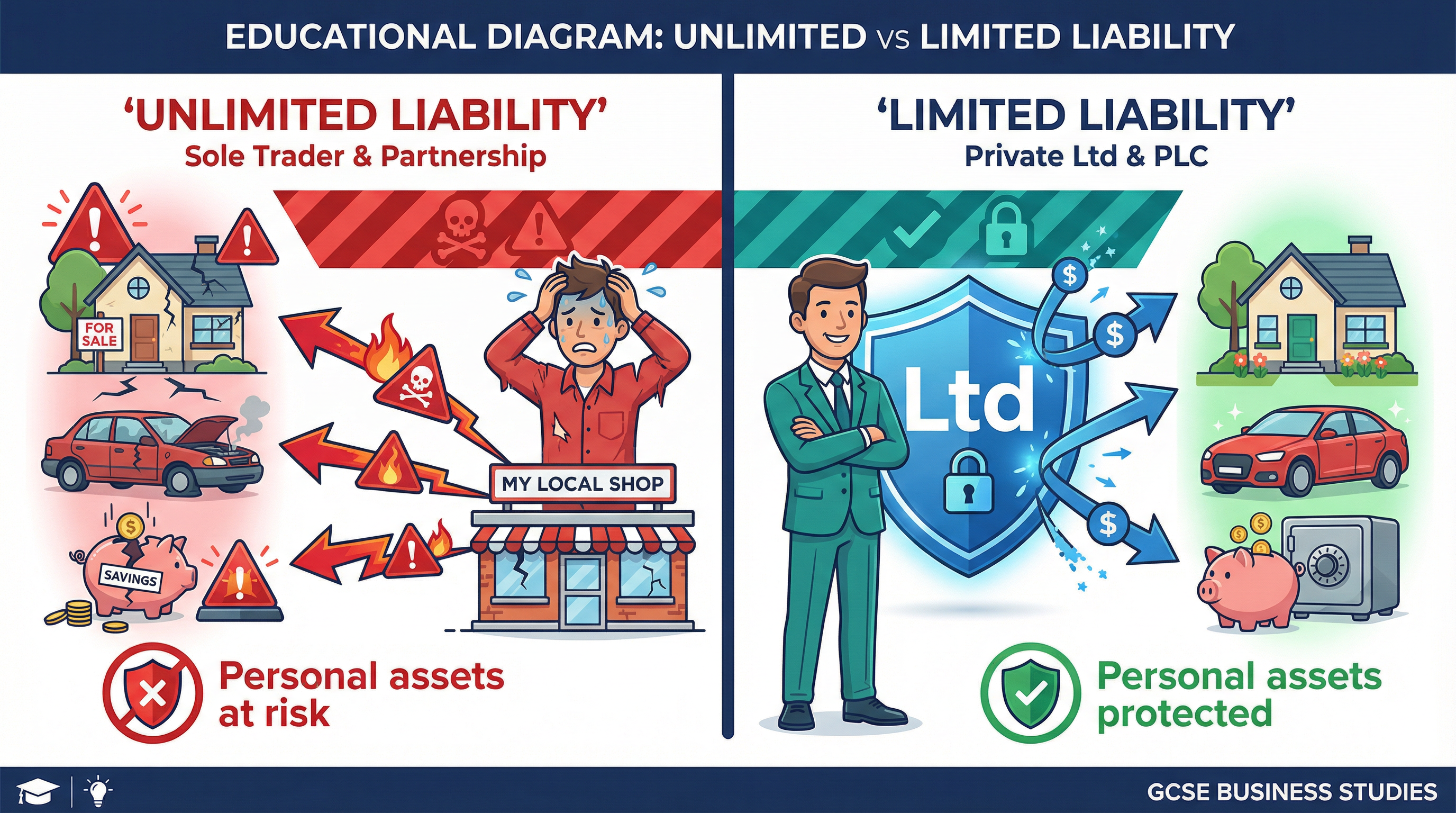

Why it matters: This is the entry point for most entrepreneurs. Examiners will expect you to understand that while it offers complete control and all the profits, it comes with the significant drawback of unlimited liability. This means the owner's personal assets (like their house or car) can be used to pay off business debts. This is a critical point for analysis.

Specific Knowledge: No formal legal process to set up. Must inform HMRC. Examples: a local plumber, a freelance writer, a small independent coffee shop.

Partnership

What it is: A business owned by two or more people (up to 20 in a standard partnership). The owners share the profits, and usually the workload and decision-making.

Why it matters: Partnerships allow for more capital to be invested than a sole trader and a broader range of skills. However, they also suffer from unlimited liability, and partners are jointly responsible for the debts of the business. The potential for conflict between partners is also a key evaluation point.

Specific Knowledge: A Deed of Partnership is a legal document that outlines the rights and responsibilities of each partner. While not legally required, it is highly recommended to avoid future disputes.

Private Limited Company (Ltd)

What it is: An incorporated business, meaning it has a separate legal identity from its owners (the shareholders). Ownership is restricted, and shares can only be sold privately with the agreement of all shareholders.

Why it matters: The key advantage is limited liability. This protects the personal wealth of the shareholders, as they are only liable for the amount they have invested. This makes it easier to attract investors and raise capital for growth. Examiners will credit candidates who can explain how this protection encourages entrepreneurship and risk-taking.

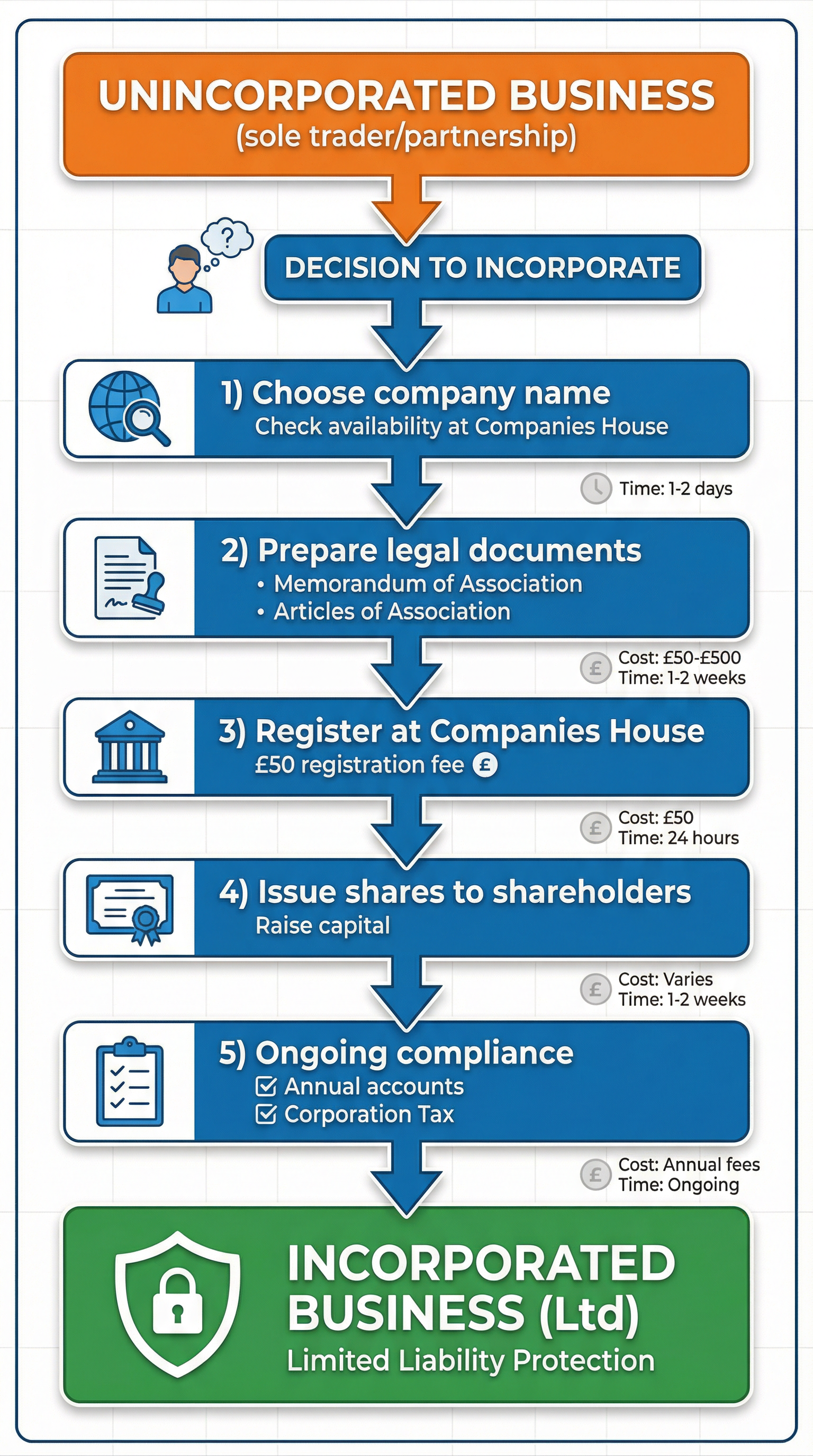

Specific Knowledge: Must be registered at Companies House. Financial information is made public. The process of setting up is called incorporation.

Public Limited Company (PLC)

What it is: An incorporated business that can sell its shares to the general public on the stock exchange.

Why it matters: This is the structure for large, well-established businesses. It allows them to raise vast amounts of capital for expansion. However, this comes at a cost: the risk of a hostile takeover, increased public scrutiny, and the dilution of control for the original owners.

Specific Knowledge: Must have a minimum of £50,000 in share capital. Subject to a high level of regulation and media attention. Examples: Tesco PLC, Barclays PLC, Marks and Spencer PLC.

Second-Order Concepts

Liability

Unlimited Liability: The owner(s) of the business are personally responsible for all of its debts. There is no legal distinction between the owner's personal assets and the business's assets. This applies to Sole Traders and Partnerships.

Limited Liability: The liability of the owners is limited to the amount of money they have invested in the business. Their personal assets are protected. This applies to Private Limited Companies (Ltd) and Public Limited Companies (PLC).

Ownership vs. Control

In smaller businesses like sole traders and partnerships, ownership and control are typically held by the same people. However, in larger companies (especially PLCs), there is a separation of ownership and control. The shareholders own the company, but it is run by a board of directors. This can lead to conflicts of interest, known as the principal-agent problem.

Incorporation

This is the legal process of creating a company, so it becomes a separate legal entity from its owners. It provides the protection of limited liability but involves more administrative work and cost. Examiners expect you to understand the steps and implications of this process.