Study Notes

Overview

Welcome to your deep dive into the calculation of profit and loss for Edexcel GCSE Business. This topic is the bedrock of business finance, and mastering it is non-negotiable for achieving a high grade. Examiners expect candidates to demonstrate precise quantitative skills, applying the correct formulas to case study data, and then using the results to build chains of analytical reasoning. This guide will equip you with the knowledge to distinguish between gross and net profit, the technique to structure your calculations for maximum marks, and the analytical frameworks to evaluate business performance. We will explore how profit figures inform crucial business decisions, from securing loans to funding expansion. By the end of this guide, you will not only be able to calculate profit and loss accurately but also understand its profound significance for any business.

Key Concepts & Formulas

The Core Formulas

Understanding the language of profit is the first step. Examiners will credit you for stating the correct formula before you even start calculating. It's a simple way to secure method marks.

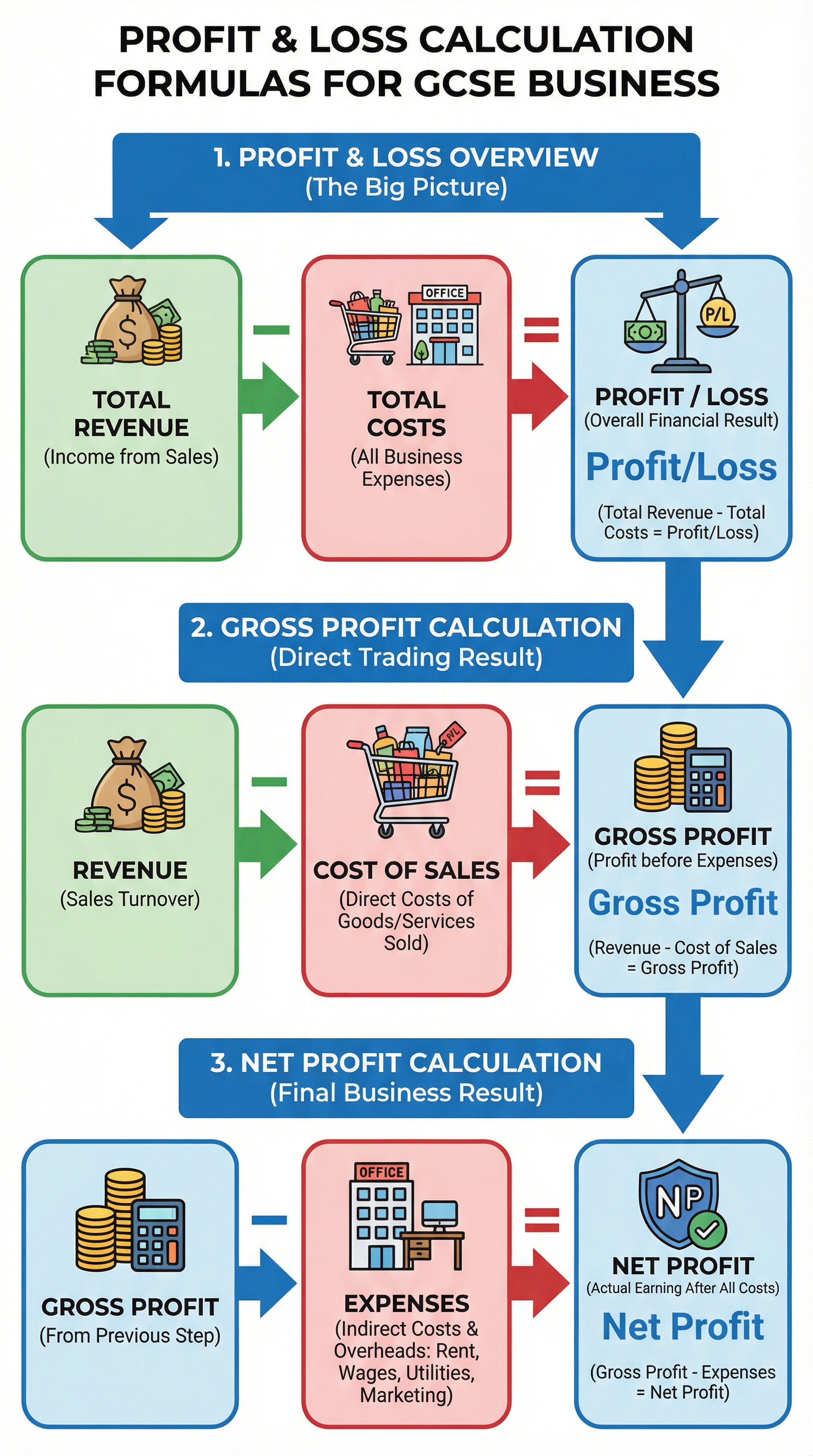

1. Total Profit / Loss

- Formula:

Total Revenue - Total Costs = Profit / Loss - What it means: This is the ultimate measure of a business's financial success over a period. It provides the final answer to the question: "Did the business make more money than it spent?"

- Examiner Tip: This is the foundational formula. While often broken down further, it's the "big picture" calculation.

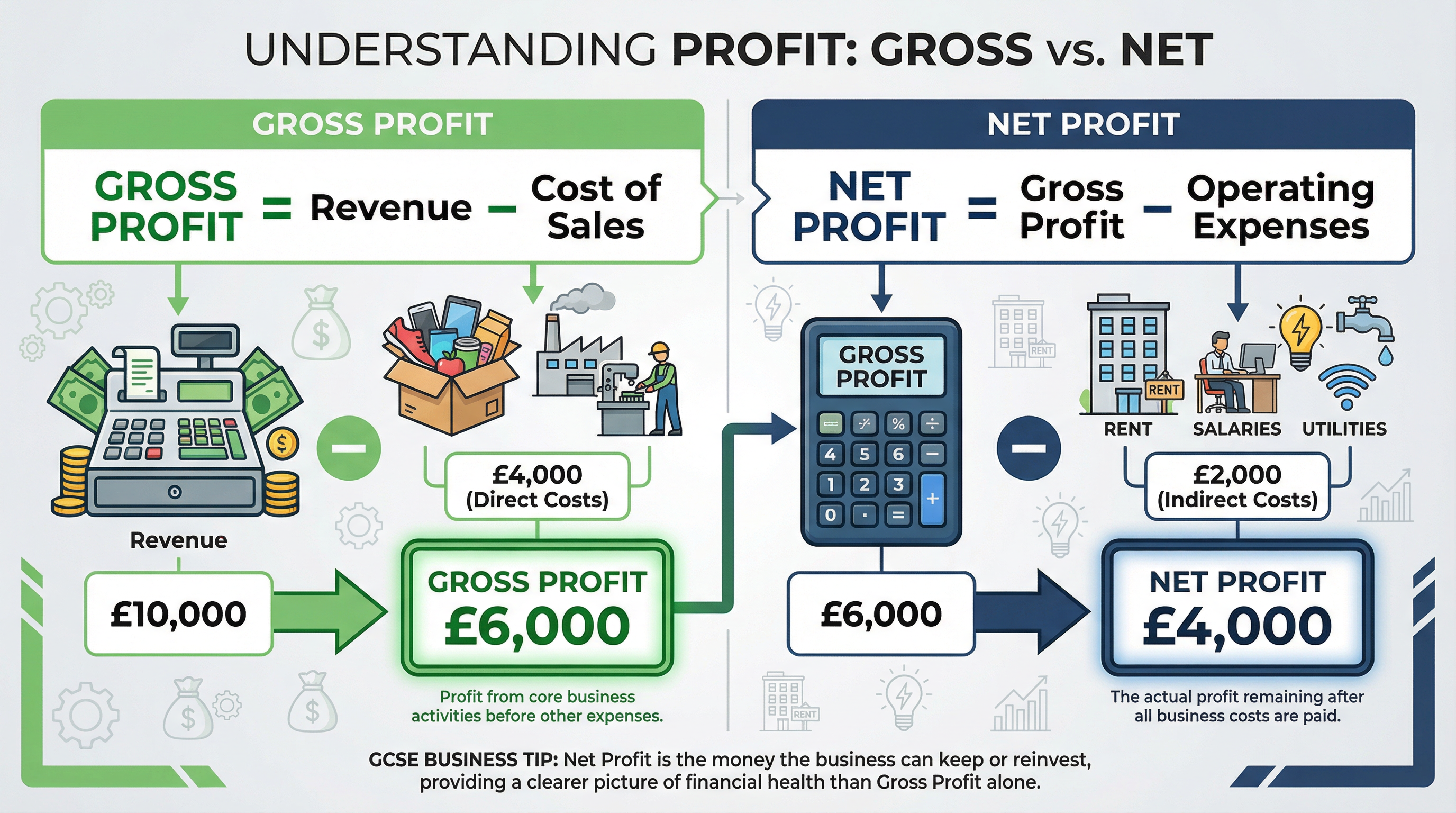

2. Gross Profit

- Formula:

Revenue - Cost of Sales = Gross Profit - What it means: Gross profit measures the profitability of a business's core trading activity—buying or making and then selling a product. It strips out all other operational overheads.

- Specific Knowledge: 'Cost of Sales' (or 'Cost of Goods Sold') are the direct costs associated with producing the goods sold. For a retailer, this is the cost of buying stock. For a manufacturer, it's the raw materials and direct labour.

3. Net Profit

- Formula:

Gross Profit - Expenses = Net Profit - What it means: This is the "bottom line"—the actual profit left for the owners after all costs have been deducted from revenue. It represents the true financial health of the business.

- Specific Knowledge: 'Expenses' (or 'overheads') are the indirect costs of running the business, such as rent, marketing, administrative salaries, and utility bills.

Distinguishing Revenue, Profit, and Cash

A very common mistake made by candidates is to confuse these three terms. Marks are frequently lost for using them interchangeably in analysis.

| Term | Definition | Context & Exam Relevance |

|---|---|---|

| Revenue | The total amount of income generated by the sale of goods or services. | Also known as 'turnover' or 'sales'. A high revenue does not automatically mean high profit. Examiners look for candidates who understand that a business can have high sales but still make a loss if costs are not controlled. |

| Profit | The financial gain made when revenue exceeds total costs. | This is a measure of profitability. It is a historical figure calculated over a period of time (e.g., a month or a year). It is an opinion, as it depends on accounting conventions like depreciation. |

| Cash | The money a business has available in its bank account at a single point in time. | This is a measure of liquidity. A business can be profitable but run out of cash if customers don't pay on time. Cash is a fact, not an opinion. Cash flow is vital for survival. |

Second-Order Concepts

Causation

- What causes profit to rise or fall? A rise in profit can be caused by increased revenue (higher prices or more sales volume) or by a reduction in costs (cheaper suppliers, improved efficiency). Conversely, a fall in profit is caused by falling revenue or rising costs.

- Triggers for Loss: A business might fall into a loss due to a sudden spike in raw material costs, a new competitor entering the market and forcing prices down, or a significant drop in customer demand.

Consequence

- Consequences of High Profit: Sustained high profits allow a business to reinvest in new assets, expand into new markets, pay higher dividends to shareholders, and more easily secure external finance like bank loans.

- Consequences of a Loss: Making a loss erodes the capital of the business. It may lead to a need for an overdraft, job cuts to reduce costs, a reduction in investment, and, if sustained, the ultimate failure of the business.

Significance

- Why does profit matter so much? Profit is the primary motivator for most private sector businesses. It is a key indicator of success, a source of finance for future growth, and a reward for the risks taken by entrepreneurs. For examiners, your ability to explain the significance of a calculated profit figure is what separates a top-level answer from a mid-level one.

Exam Technique & Calculation Skills

How to Structure Your Calculation

Examiners follow a mark scheme that awards marks for method, substitution, and accuracy. Follow this structure every single time:

- State the formula: Write out the formula in words or symbols (e.g., "Gross Profit = Revenue - Cost of Sales").

- Substitute the figures: Insert the numbers from the case study (e.g., "Gross Profit = £50,000 - £20,000").

- Calculate the answer: Show the final result (e.g., "Gross Profit = £30,000").

- Include the £ sign and correct decimal places: Always include the currency symbol and ensure your answer is to two decimal places if necessary (e.g., £4.50, not 4.5).

The Own Figure Rule (OFR)

This is a lifeline in multi-part questions. If you make a calculation error in part (a), but then correctly use that incorrect figure in part (b), you will still be awarded the marks for part (b). This means:

- Never leave a question blank just because you're unsure about an earlier answer.

- Always show your working so the examiner can apply the OFR.

- Carry your figures forward even if you think they might be wrong.

Presenting a Loss

If your calculation results in a negative number, you must make this absolutely clear. Acceptable ways to present a loss include:

- Negative sign: -£2,000

- Brackets: (£2,000)

- The word "Loss": £2,000 Loss

Do NOT just write £2,000 without any indication that it's a loss, as the examiner will assume you've misunderstood the question.

Named Example Bank

-

Tesco PLC (2022 Financial Year): Revenue of £64.8 billion, Cost of Sales of £60.2 billion, giving a Gross Profit of £4.6 billion. After deducting operating expenses of £2.1 billion, Net Profit was £2.5 billion. This demonstrates how even a small percentage margin on huge revenue can generate substantial profit.

-

Local Bakery Case Study (Exam-Style): A small bakery has monthly revenue of £8,000 from selling cakes and pastries. The cost of ingredients and direct labour (Cost of Sales) is £3,200. The bakery also pays £1,500 in rent, £800 in utilities, and £600 in marketing (Expenses). Gross Profit = £8,000 - £3,200 = £4,800. Net Profit = £4,800 - (£1,500 + £800 + £600) = £4,800 - £2,900 = £1,900.

-

Tech Startup Scenario: A tech startup has revenue of £150,000 in its first year. However, the cost of developing the software (Cost of Sales) was £80,000, and operating expenses (office rent, salaries, marketing) totalled £90,000. Gross Profit = £150,000 - £80,000 = £70,000. Net Profit = £70,000 - £90,000 = -£20,000 (a loss of £20,000). This shows that even with healthy revenue, high expenses can lead to a loss.

-

Retailer with Seasonal Variation: A garden centre has revenue of £120,000 in the summer quarter and £40,000 in the winter quarter. Cost of Sales is 60% of revenue in both quarters. Summer Gross Profit = £120,000 - (£120,000 × 0.6) = £120,000 - £72,000 = £48,000. Winter Gross Profit = £40,000 - (£40,000 × 0.6) = £40,000 - £24,000 = £16,000. This illustrates how profit can fluctuate with seasonal demand.

-

Manufacturing Business: A furniture manufacturer has annual revenue of £500,000. The cost of raw materials (wood, fabric, screws) and factory workers' wages (Cost of Sales) is £200,000. The business also incurs £80,000 in rent for the factory and showroom, £40,000 in administrative salaries, and £30,000 in marketing (Expenses). Gross Profit = £500,000 - £200,000 = £300,000. Net Profit = £300,000 - (£80,000 + £40,000 + £30,000) = £300,000 - £150,000 = £150,000.

Podcast Script

A full 10-minute educational podcast is included with this study guide. The podcast covers:

- Introduction (1 minute): Why profit and loss calculations are essential for GCSE Business success.

- Core Concepts (5 minutes): Detailed explanation of the formulas for Total Profit/Loss, Gross Profit, and Net Profit, with worked examples.

- Exam Tips & Common Mistakes (2 minutes): How to maximise marks, the Own Figure Rule, and how to avoid confusing Gross and Net Profit.

- Quick-Fire Recall Quiz (1 minute): Five questions to test your understanding.

- Summary & Sign-Off (1 minute): Key takeaways and final encouragement.

Listen to the podcast to reinforce your learning and hear the concepts explained in a conversational, engaging style.