Study Notes

Overview

Welcome to one of the most critical topics in your GCSE Business course: Making the Business Effective. This section, part of Edexcel Theme 2, moves beyond ideas and into the numbers that prove whether a business is truly successful. Examiners expect candidates to demonstrate strong financial literacy, not just by calculating key ratios, but by using them to analyze performance and evaluate strategic options. You will be expected to calculate and interpret Gross Profit Margin (GPM), Net Profit Margin (NPM), and Average Rate of Return (ARR). A strong performance in this area requires you to connect the numbers to the business context (AO2) and use them to build persuasive arguments (AO3). This guide will break down these concepts, provide clear worked examples, and show you how to think like a senior examiner to maximize your marks.

Key Concepts: Profitability Ratios

Gross Profit and Gross Profit Margin (GPM)

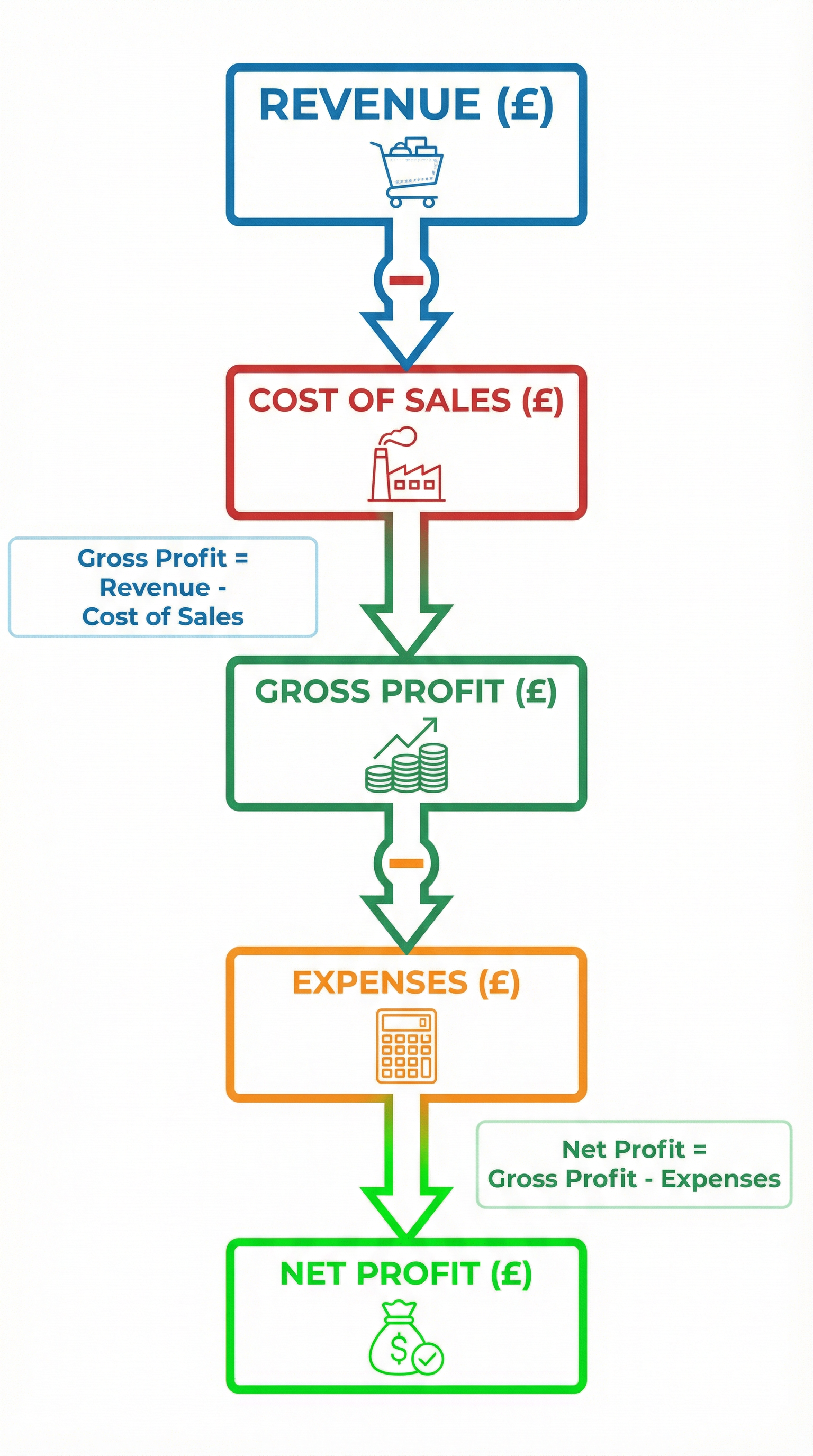

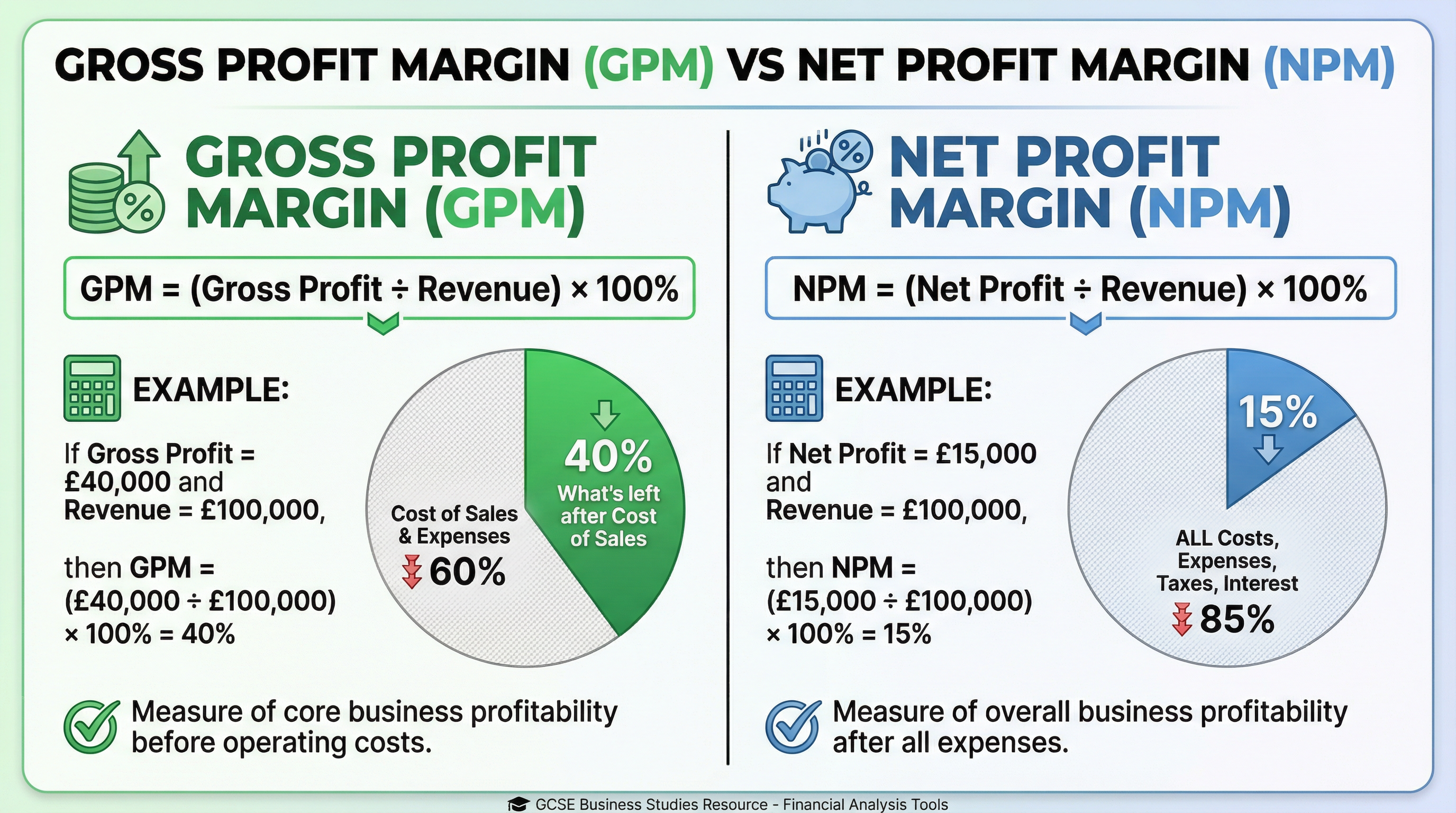

What it is: Gross Profit is the profit a business makes from buying and selling goods, before any other costs are taken into account. The Gross Profit Margin (GPM) turns this into a percentage, showing how much gross profit is generated for every £1 of revenue.

Formula: Gross Profit = Revenue - Cost of Sales

Formula: GPM = (Gross Profit / Revenue) * 100

Why it matters: GPM is a crucial indicator of a business's core operational efficiency. It reveals how well a company is managing the direct costs associated with producing its goods or services. A falling GPM might indicate that the cost of raw materials is rising, or that the business has been forced to lower its prices due to competitive pressure. Examiners award credit for candidates who can identify these specific operational causes.

Net Profit and Net Profit Margin (NPM)

What it is: Net Profit is the final profit left after all costs—including operating expenses, interest, and taxes—have been deducted from revenue. The Net Profit Margin (NPM) expresses this as a percentage of revenue.

Formula: Net Profit = Gross Profit - Other Operating Expenses and Interest

Formula: NPM = (Net Profit / Revenue) * 100

Why it matters: NPM provides a comprehensive measure of a business's overall profitability. While GPM focuses on production efficiency, NPM accounts for all aspects of a company's financial health, including its management of overheads like rent, marketing, and administrative salaries. A business could have a healthy GPM but a poor NPM, indicating that its operating expenses are too high. Examiners look for this kind of nuanced analysis.

Key Concepts: Investment Appraisal

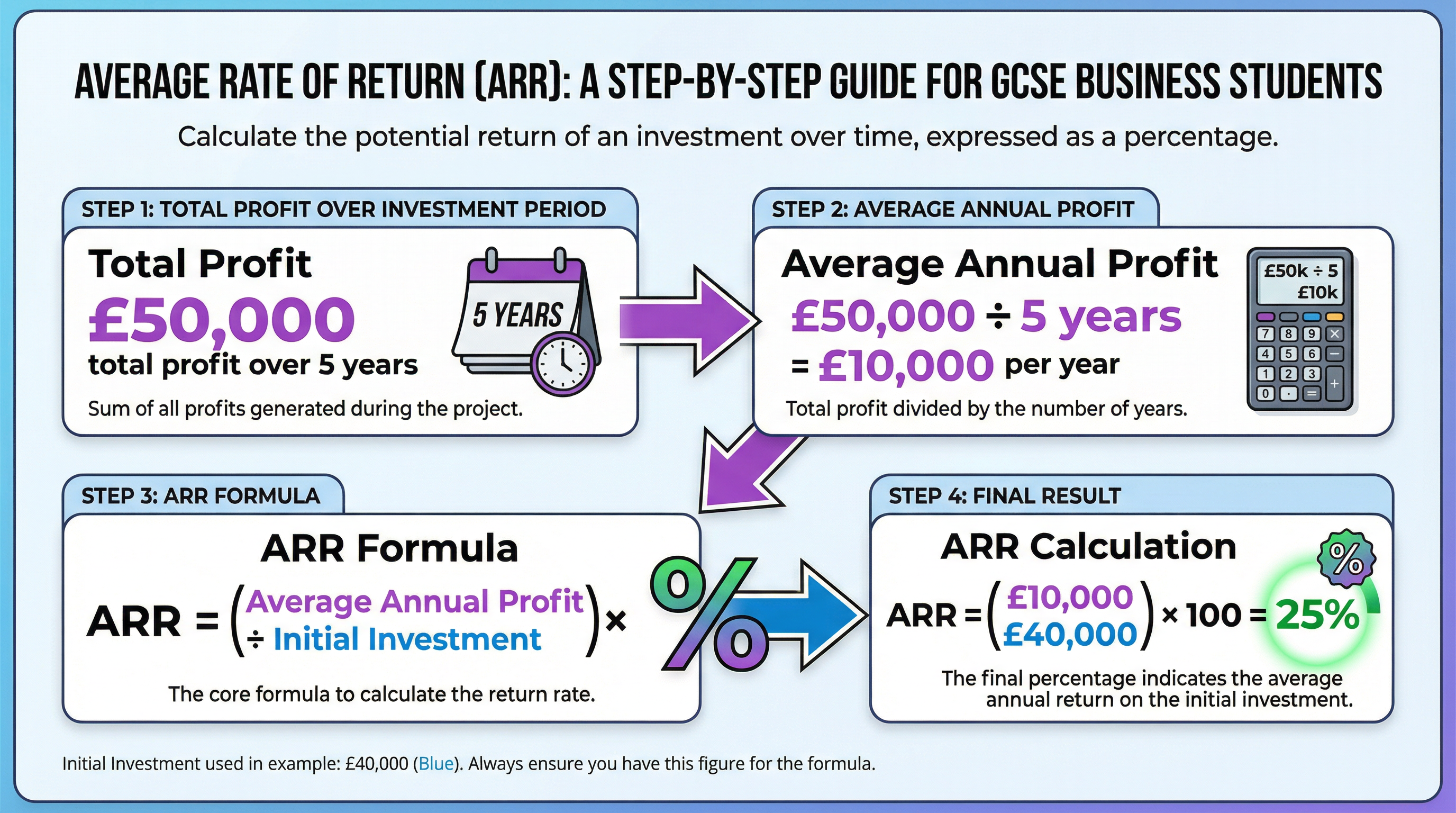

Average Rate of Return (ARR)

What it is: ARR is a method used to assess the profitability of a potential investment. It calculates the average annual profit an investment is expected to generate as a percentage of the initial cost of that investment.

Formula: ARR = (Average Annual Profit / Initial Investment) * 100

To find Average Annual Profit, you calculate: (Total Profit over the project's life) / (Number of years)

Why it matters: Businesses use ARR to compare different investment opportunities and decide which one is likely to be the most profitable. For your exam, you will be expected to calculate ARR for different scenarios and use your findings to justify a choice. However, a high-level evaluation (for 9- and 12-mark questions) will also consider the limitations of ARR. For instance, it doesn't account for the timing of cash flows (unlike the Net Present Value method you might encounter at A-Level) and it relies on profit forecasts, which can be inaccurate.