Study Notes

Overview

The Economic Climate is one of the most exam-relevant topics in OCR GCSE Business because it tests your ability to apply economic theory to real-world business decision-making. This topic covers four key external factors that businesses cannot control but must respond to strategically: interest rates, exchange rates, consumer income levels, and taxation. Unlike internal factors such as management decisions or marketing strategies, these economic variables are set by external forces—the Bank of England, global currency markets, the economic cycle, and government fiscal policy. Your task as a candidate is to demonstrate how changes in these factors create chains of cause and effect that impact business costs, consumer demand, and ultimately profitability. Examiners expect you to move beyond simple definitions and show analytical thinking by explaining mechanisms, contextualizing impacts to specific business types, and evaluating the relative significance of different economic changes. This topic appears across multiple question types, from short 4-6 mark "Explain" questions to longer 9-12 mark "Discuss" or "To what extent" evaluation questions, making it essential for achieving top grades.

Key Economic Factors

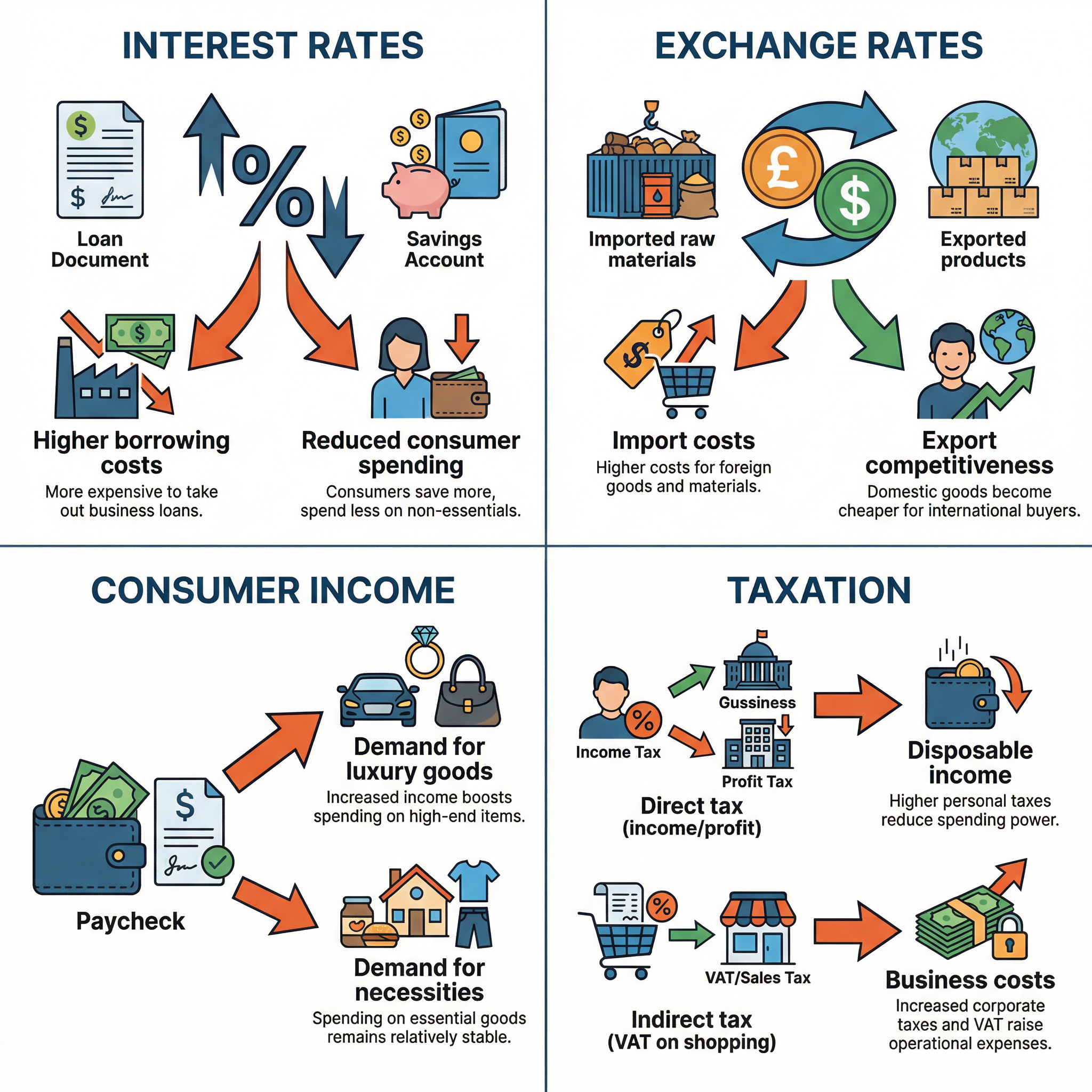

Interest Rates

What They Are: Interest rates represent the cost of borrowing money, set by the Bank of England through the Monetary Policy Committee. When the Bank raises or lowers the base rate, commercial banks adjust their lending and savings rates accordingly.

Impact on Business Costs: When interest rates rise, businesses with overdrafts, loans, or mortgages face higher monthly repayments. For example, a small retailer with a £50,000 overdraft would see annual interest costs increase by £1,500 if rates rose from 2% to 5%. This directly reduces profit margins and may force businesses to cut costs elsewhere, delay expansion plans, or increase prices to maintain profitability. Cash-rich businesses with significant savings may benefit from higher interest earned, but this is less common for small and medium enterprises.

Impact on Consumer Demand: Rising interest rates reduce consumer disposable income because households with mortgages face higher monthly payments. This leads to reduced spending on non-essential goods—luxury items, holidays, dining out, and high-end electronics. Businesses selling income-elastic products (those where demand is sensitive to income changes) experience sharp falls in revenue. However, businesses selling necessities such as basic food, utilities, and essential clothing see much smaller demand changes because consumers continue purchasing these regardless of income fluctuations.

Functional Area Impacts: The Finance department must manage increased borrowing costs and potentially renegotiate loan terms. Marketing may need to adjust campaigns to emphasize value and affordability. Operations might delay capital investment in new equipment due to higher financing costs. Human Resources could face pressure to freeze wages or reduce headcount to control costs.

Exchange Rates

What They Are: Exchange rates measure the value of one currency against another, such as the British pound (£) against the US dollar ($) or the euro (€). Exchange rates fluctuate based on supply and demand in global currency markets, influenced by factors including interest rate differentials, economic growth, and investor confidence.

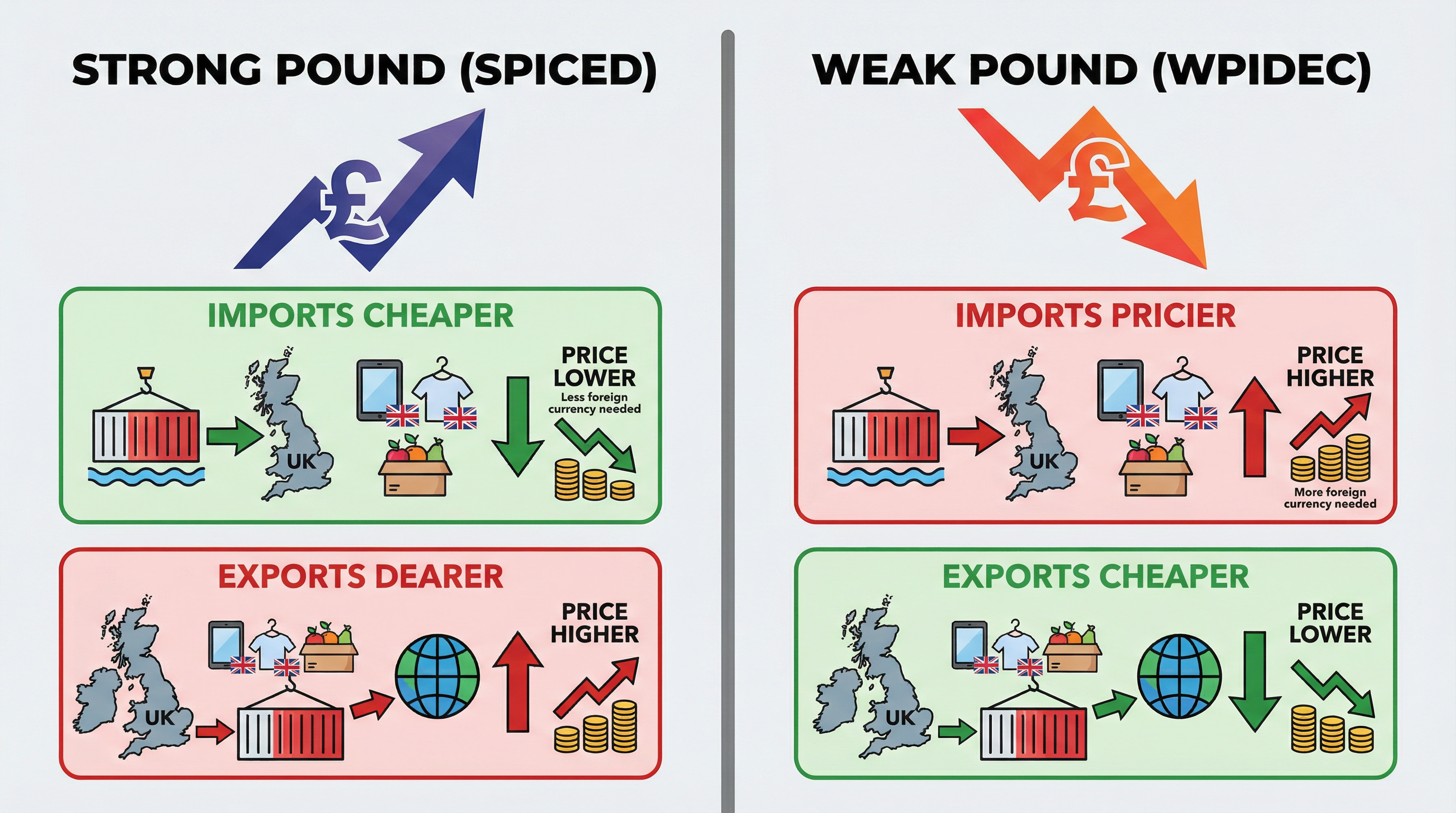

SPICED vs WPIDEC: These two mnemonics are essential for avoiding the most common mistake in exam answers—reversing the effects of currency strength.

- SPICED: Strong Pound, Imports Cheaper, Exports Dearer

- WPIDEC: Weak Pound, Imports Pricier, Exports Cheaper

Strong Pound Scenario: When the pound strengthens (e.g., from £1 =

Weak Pound Scenario: When the pound weakens (e.g., from £1 = €1.20 to £1 = €1.00), importers face higher costs as they need more pounds to buy the same euro-priced goods. This may force businesses to increase prices, risking reduced demand, or absorb the cost increase, reducing profit margins. Exporters benefit significantly as their products become cheaper and more competitive in foreign markets, boosting sales volume and revenue.

Contextual Application: The impact depends on the business's reliance on imports versus exports. A business importing 80% of its raw materials will be heavily impacted by a weak pound, whereas a business exporting 70% of its products will benefit. Always refer to the specific business scenario in the case study.

Consumer Income

What It Is: Consumer income levels fluctuate with the economic cycle—periods of growth (boom), peak, recession, and recovery. During economic growth, wages rise, unemployment falls, and consumer confidence increases. During recessions, incomes stagnate or fall, unemployment rises, and consumers become cautious.

Income Elasticity of Demand: This concept is critical for exam success. Income-elastic goods are luxury items where demand changes significantly with income fluctuations—designer clothing, premium cars, foreign holidays, high-end electronics. When incomes rise by 10%, demand for these goods might rise by 20% or more. Conversely, when incomes fall, demand collapses. Income-inelastic goods are necessities where demand remains relatively stable regardless of income changes—bread, milk, basic utilities, essential medicines. A 10% income fall might only reduce demand by 2-3%.

Business Strategy Implications: Businesses selling luxury goods must prepare for volatile demand, maintaining financial reserves during boom periods to survive recessions. Businesses selling necessities enjoy stable demand but may face increased competition from consumers trading down from premium brands. Discount retailers like Aldi and Lidl often see increased demand during recessions as consumers switch from higher-priced competitors.

Exam Application: When analyzing the impact of rising or falling consumer income, always identify whether the business sells income-elastic or income-inelastic products. This determines the magnitude of the demand change and the appropriate business response.

Taxation

Direct Taxation: Taxes on income and profit, including income tax (on employee wages) and corporation tax (on business profits). When the government raises income tax, workers' disposable income falls, reducing consumer spending across the economy. This impacts businesses through lower sales revenue, particularly for non-essential goods. When corporation tax rises, businesses retain less profit after tax, reducing funds available for reinvestment, expansion, dividends, or building financial reserves. A business earning £100,000 profit faces a £6,000 reduction in retained profit if corporation tax rises from 19% to 25%.

Indirect Taxation: Taxes on spending, primarily VAT (Value Added Tax), currently 20% on most goods and services in the UK. When VAT increases, the price consumers pay rises, which can reduce demand, especially for price-sensitive products. Businesses face a strategic decision: absorb the VAT increase (reducing profit margin) or pass it on to customers (risking lower sales volume). The optimal choice depends on price elasticity of demand and competitive positioning.

Functional Area Impacts: Finance must calculate the tax impact on cash flow and profitability. Marketing may need to adjust pricing strategies or emphasize value to offset higher prices. Operations might seek cost efficiencies to maintain margins despite higher tax burdens.

Developed Chains of Reasoning: The BLT Structure

Examiners award marks for developed explanations that show the mechanism linking cause to effect. The BLT structure—Because, Leading to, Therefore—ensures you build complete chains of reasoning.

Example Without BLT (Low Marks): "Interest rates have increased, so profits will fall."

Example With BLT (High Marks): "Because interest rates have increased from 2% to 5%, leading to higher monthly overdraft repayments for the business, which increases Finance costs by approximately £1,500 per year, therefore profit margins will be squeezed, potentially forcing the business to increase prices to customers or cut costs in other functional areas such as Marketing or Human Resources to maintain profitability."

The BLT structure forces you to explain why the change occurs, what mechanism creates the impact, and what specific business consequence results. This analytical approach is rewarded at Level 3 and Level 4 in OCR mark schemes.

Contextualizing Economic Impacts

A critical skill for top marks is contextualizing economic changes to the specific business scenario provided in the case study. The same economic change impacts different businesses in different ways.

Interest Rate Rise:

- Heavily indebted business (large overdraft, multiple loans): Significant cost increase, major profit impact

- Cash-rich business (substantial savings, no borrowing): Minimal cost impact, may benefit from higher interest earned

Strong Pound:

- Importer-reliant business (80% of raw materials imported): Major cost reduction, increased profit margins

- Exporter-focused business (70% of sales to foreign markets): Reduced competitiveness, falling sales revenue

Falling Consumer Income:

- Luxury goods retailer (designer clothing, premium electronics): Sharp demand fall, revenue collapse

- Discount supermarket (budget food, essentials): Stable or increased demand as consumers trade down

Always refer to specific data from the case study—percentages, financial figures, market focus—to justify your analysis. Examiners reward candidates who apply economic theory to the specific business context rather than writing generic answers.

Synoptic Links Across the Specification

The Economic Climate connects to multiple other topics across the OCR J204 specification, and examiners reward candidates who demonstrate these links.

Link to Business Objectives: A business focused on profit maximization will be highly sensitive to economic changes that impact costs or revenue. A business prioritizing survival during a recession may accept lower profit margins to maintain sales volume.

Link to Marketing Mix: Economic changes force businesses to adjust the 4 Ps. Rising interest rates may require price increases or promotional discounts to maintain demand. Falling consumer income may shift product focus from premium to budget ranges. Promotion campaigns may emphasize value and affordability during recessions.

Link to Cash Flow Management: Rising interest rates increase cash outflows for loan repayments. Falling consumer income reduces cash inflows from sales. Businesses must manage working capital carefully to avoid liquidity crises.

Link to Stakeholder Objectives: Economic changes create conflicts between stakeholders. Shareholders want maintained dividends despite falling profits. Employees want job security despite cost-cutting pressures. Customers want stable prices despite rising business costs. Candidates who analyze these stakeholder tensions demonstrate sophisticated understanding.

Podcast: The Economic Climate Explained

Listen to this 10-minute educational podcast for a comprehensive audio explanation of The Economic Climate, including core concepts, exam tips, common mistakes, and a quick-fire recall quiz. The podcast is structured to reinforce your understanding and prepare you for exam success.

Quick Summary

- Interest rates are set by the Bank of England and impact business borrowing costs and consumer spending on non-essentials

- SPICED: Strong Pound, Imports Cheaper, Exports Dearer

- WPIDEC: Weak Pound, Imports Pricier, Exports Cheaper

- Income-elastic goods (luxuries) see large demand changes with income fluctuations; income-inelastic goods (necessities) see small demand changes

- Direct taxation (income tax, corporation tax) reduces disposable income and retained profit

- Indirect taxation (VAT) increases prices and may reduce demand

- Use BLT structure (Because, Leading to, Therefore) to build developed chains of reasoning

- Always contextualize economic impacts to the specific business scenario in the case study