Study Notes

Overview

Externalities are a cornerstone of market failure theory and appear repeatedly across Edexcel GCSE Economics exam papers. An externality occurs when the production or consumption of a good or service creates costs or benefits for third parties who are not directly involved in the transaction. These external effects are ignored by the price mechanism, leading to allocative inefficiency and welfare loss.

Candidates must understand the distinction between private costs and benefits (borne by producers and consumers) and social costs and benefits (which include external effects on third parties). Examiners award marks for precise definitions, accurate calculations using the formulas Social Cost = Private Cost + External Cost and Social Benefit = Private Benefit + External Benefit, and contextual application to real-world examples such as carbon taxes, congestion charges, and vaccination programmes.

This topic links directly to government intervention, welfare economics, and the role of the state in correcting market failures. Mastery of externalities is essential not only for standalone questions but also for synoptic evaluation questions that require candidates to assess the effectiveness of policy interventions.

Key Concepts and Definitions

What is an Externality?

An externality is defined as a cost or benefit that affects a third party who did not choose to incur that cost or benefit. The key characteristic is that these effects occur outside the market transaction and are therefore not reflected in market prices. When a factory emits pollution, the cost of that pollution is borne by local residents, not by the factory owner or the customers purchasing the factory's products. This divergence between private and social costs creates market failure.

The Four Types of Externalities

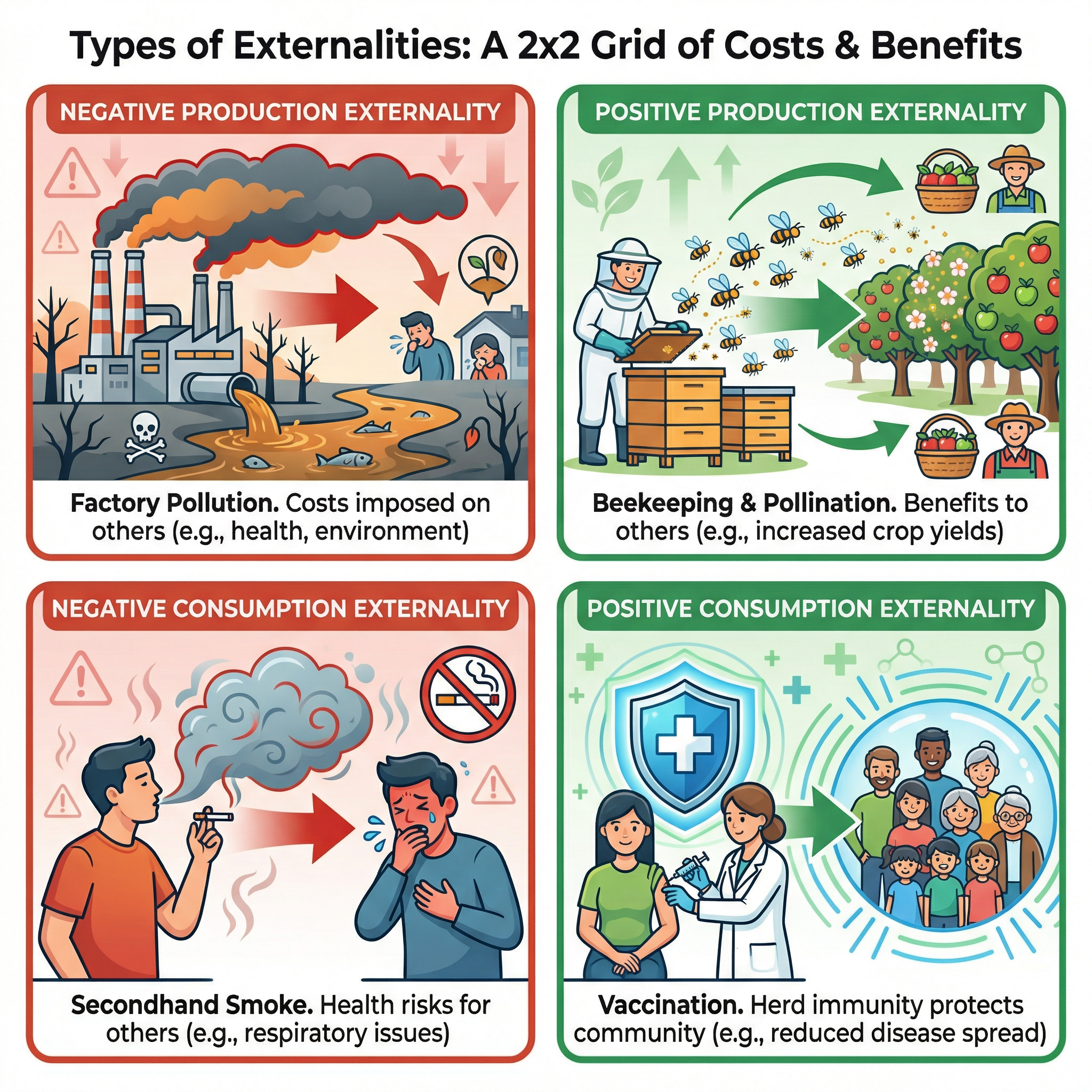

Externalities are classified into four categories based on whether they arise from production or consumption, and whether they are positive or negative.

1. Negative Production ExternalitiesThese occur when the production of a good imposes costs on third parties. Classic examples include:

- Factory pollution: A chemical plant discharges waste into a river, harming fish populations and making water unsafe for local communities.

- Noise pollution: A construction site operating at night disturbs nearby residents.

- Deforestation: Logging companies clear forests, reducing biodiversity and increasing carbon emissions.

In each case, the private cost to the producer (wages, raw materials, machinery) is lower than the social cost, which includes the external cost imposed on third parties. This leads to overproduction because the market price does not reflect the true cost to society.

2. Positive Production ExternalitiesThese occur when production creates benefits for third parties. Examples include:

- Beekeeping and pollination: A beekeeper produces honey, but the bees also pollinate nearby crops, increasing yields for local farmers who did not pay for this service.

- Research and development: A pharmaceutical company develops a new drug, and the knowledge generated benefits other researchers and firms.

- Training and skills development: A firm invests in training its workers, who later move to other companies, spreading skills across the economy.

Here, the social benefit exceeds the private benefit, leading to underproduction in a free market.

3. Negative Consumption ExternalitiesThese arise when the consumption of a good harms third parties. Examples include:

- Smoking: Secondhand smoke harms non-smokers, increasing their risk of respiratory diseases and cancer.

- Alcohol consumption: Excessive drinking leads to anti-social behaviour, violence, and strain on emergency services.

- Loud music or parties: Noise from private events disturbs neighbours.

The private cost to the consumer (the price of cigarettes or alcohol) is lower than the social cost, which includes healthcare costs, policing, and reduced quality of life for others. This results in overconsumption.

4. Positive Consumption ExternalitiesThese occur when consumption benefits third parties. Examples include:

- Vaccination: When individuals get vaccinated, they reduce the spread of infectious diseases, protecting others through herd immunity.

- Education: An educated population benefits society through higher productivity, lower crime rates, and better civic participation.

- Cycling instead of driving: Cyclists reduce traffic congestion and air pollution, benefiting other road users.

The social benefit exceeds the private benefit, leading to underconsumption in a free market.

Private, External, and Social Costs and Benefits

Understanding the relationship between these terms is critical for exam success.

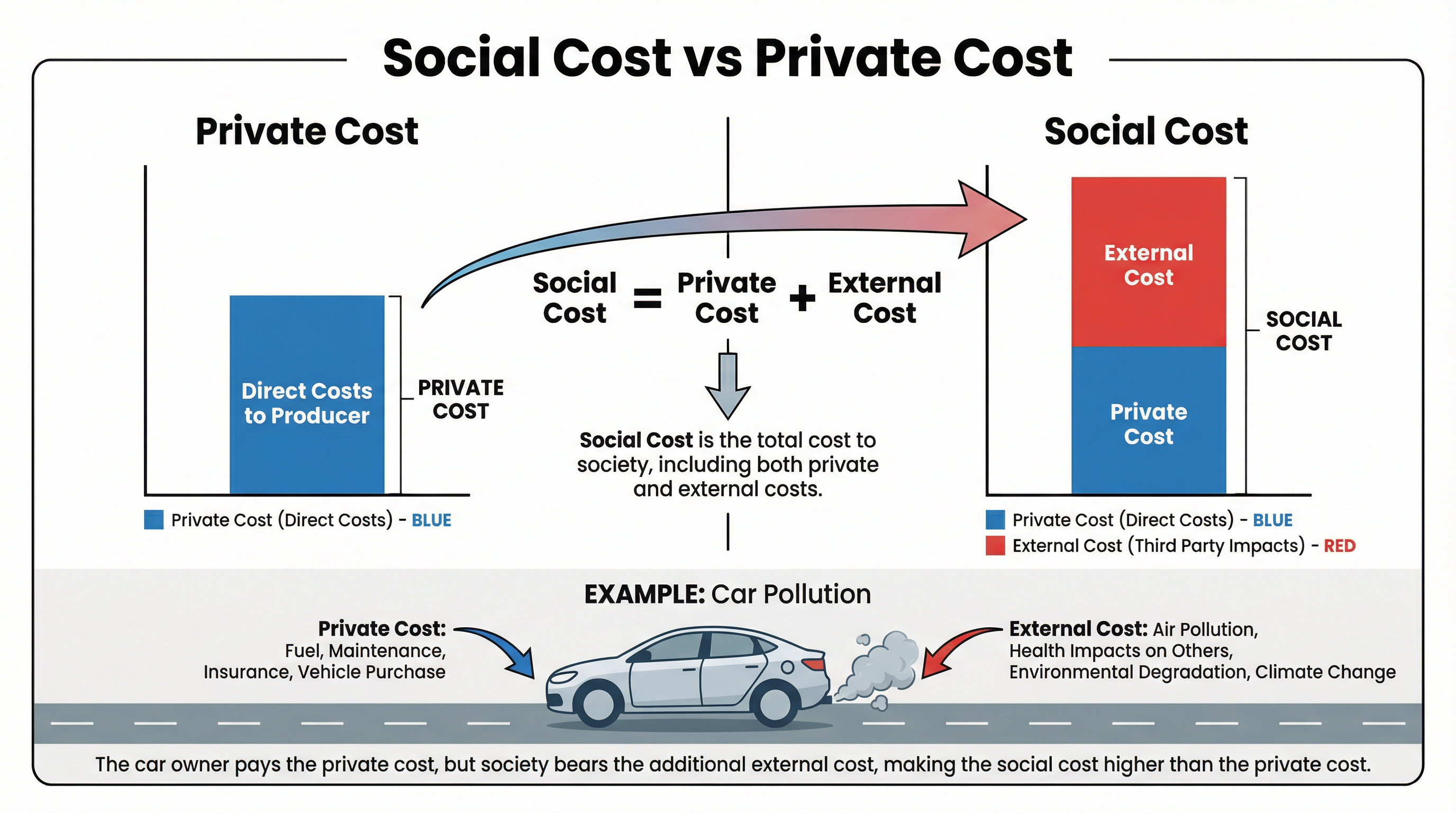

Private Cost: The cost borne directly by the producer. For a car manufacturer, this includes raw materials, labour, machinery, and energy.

External Cost: The cost imposed on third parties. For car production, this includes air pollution from factories, carbon emissions contributing to climate change, and congestion from increased car use.

Social Cost: The total cost to society, calculated as:

Social Cost = Private Cost + External Cost

Private Benefit: The benefit received directly by the consumer. For a student attending university, this includes higher future earnings and personal development.

External Benefit: The benefit received by third parties. An educated workforce benefits employers, the economy, and society through innovation and lower crime rates.

Social Benefit: The total benefit to society, calculated as:

Social Benefit = Private Benefit + External BenefitExaminers frequently test whether candidates can distinguish between these terms. A common error is to confuse social cost with external cost. Remember: social cost is the sum of private and external costs, not just the external component.

Why Externalities Cause Market Failure

In a free market, prices are determined by the interaction of supply and demand, which reflect only private costs and benefits. Producers and consumers make decisions based on their own costs and benefits, ignoring the impact on third parties.

When negative externalities exist, the market price is too low because it does not include external costs. This leads to overproduction and overconsumption. For example, if a factory does not pay for the pollution it creates, it will produce more than is socially optimal.

When positive externalities exist, the market price is too high because it does not reflect external benefits. This leads to underproduction and underconsumption. For example, if individuals only consider their own benefit from vaccination and ignore the benefit to others, fewer people will get vaccinated than is socially optimal.

This misallocation of resources represents allocative inefficiency, a key form of market failure. Resources are not being used in a way that maximises social welfare.

Government Interventions to Correct Externalities

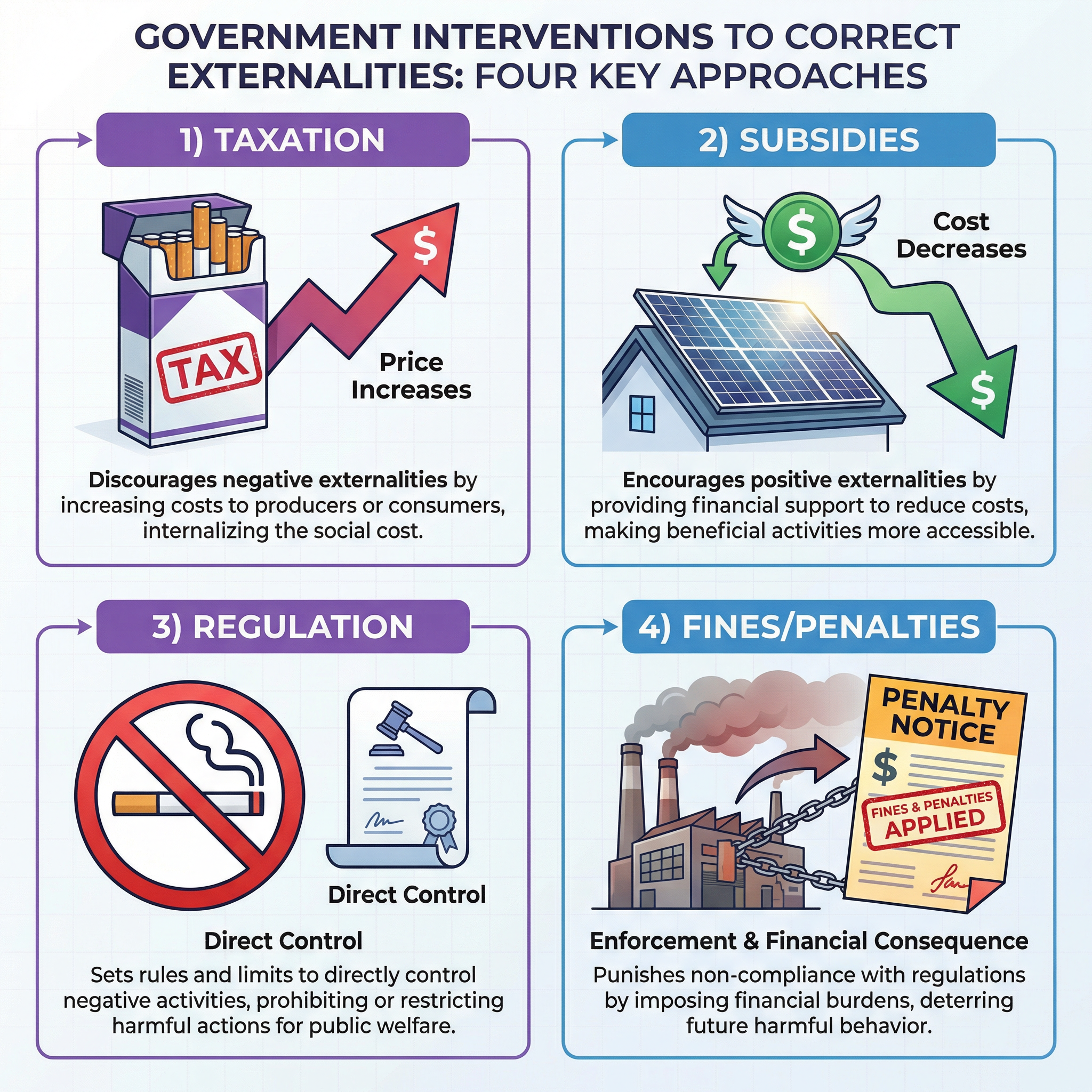

Because externalities represent market failure, governments intervene to internalize external costs and benefits—that is, to make producers and consumers take them into account.

1. Taxation (Indirect Taxes)

Governments impose taxes on goods with negative externalities to increase the price and reduce consumption or production.

How it works: A tax raises the cost to producers or consumers, shifting the supply curve leftward (or demand curve leftward for a consumption tax). This reduces the quantity produced or consumed, moving the market closer to the socially optimal level.

Examples:

- Carbon tax: Taxes on fossil fuels to reduce greenhouse gas emissions.

- Sugar tax: A levy on sugary drinks to reduce consumption and tackle obesity.

- Tobacco duty: High taxes on cigarettes to discourage smoking.

- Congestion charge: A fee for driving in city centres during peak hours to reduce traffic and pollution.

Evaluation:

- Effectiveness depends on price elasticity of demand: If demand is inelastic (e.g., for addictive goods like cigarettes), the tax may raise revenue but have little impact on consumption.

- Regressive impact: Taxes on everyday goods disproportionately affect low-income households.

- Difficulty in setting the correct tax level: Governments must estimate the size of the external cost, which is challenging.

- Potential for government failure: If the tax is set too high, it may create black markets or excessive welfare loss.

2. Subsidies

Governments provide subsidies for goods with positive externalities to reduce the price and encourage consumption or production.

How it works: A subsidy lowers the cost to producers or consumers, shifting the supply curve rightward (or demand curve rightward). This increases the quantity produced or consumed, moving the market closer to the socially optimal level.

Examples:

- Renewable energy subsidies: Grants for solar panels and wind turbines to encourage clean energy production.

- Public transport subsidies: Reduced fares to encourage use of buses and trains, reducing car use and pollution.

- Education subsidies: Free or subsidised university tuition to increase participation.

- Vaccination programmes: Free vaccines to increase uptake and achieve herd immunity.

Evaluation:

- Opportunity cost: Subsidies require government spending, which could be used elsewhere (e.g., healthcare, infrastructure).

- Risk of overproduction: If the subsidy is too large, it may lead to inefficiency.

- Deadweight loss from taxation: Subsidies are funded by taxes, which may create distortions elsewhere in the economy.

- Difficulty in targeting: Subsidies may benefit those who would have consumed the good anyway, reducing effectiveness.

3. Regulation and Legislation

Governments impose rules and laws to directly control negative externalities.

How it works: Regulations set limits on harmful activities or mandate beneficial ones. Unlike taxes, which use price signals, regulations use legal enforcement.

Examples:

- Emission limits: Legal caps on pollution from factories and vehicles.

- Smoking bans: Prohibition of smoking in public places to protect non-smokers.

- Planning restrictions: Limits on building in green spaces to protect the environment.

- Compulsory education: Laws requiring children to attend school until a certain age.

- Workplace safety standards: Rules requiring firms to provide safe working conditions.

Evaluation:

- Certainty: Regulations provide clear rules and guaranteed outcomes (e.g., a smoking ban eliminates secondhand smoke in public places).

- No revenue generation: Unlike taxes, regulations do not raise government revenue.

- Enforcement costs: Monitoring and policing compliance can be expensive.

- Inflexibility: Regulations apply uniformly and may not account for differences between firms or individuals.

- Risk of regulatory capture: Industries may lobby to weaken regulations.

4. Fines and Penalties

Governments impose financial penalties for activities that create negative externalities.

How it works: Fines punish non-compliance with regulations or directly penalise harmful behaviour.

Examples:

- Littering fines: Penalties for dropping litter in public spaces.

- Pollution fines: Charges for exceeding emission limits.

- Speeding fines: Penalties for dangerous driving.

Evaluation:

- Deterrent effect: Fines discourage harmful behaviour.

- Revenue generation: Fines can fund public services or environmental cleanup.

- Enforcement challenges: Detecting and prosecuting offenders can be difficult and costly.

- Proportionality: Fines may be too small to deter wealthy individuals or large corporations.

Named Examples for Application Marks

Edexcel examiners specifically reward candidates who apply economic theory to real-world contexts. Here are five detailed examples you should memorise:

1. London Congestion Charge (2003)

- Type: Negative consumption externality (traffic congestion, air pollution)

- Intervention: £15 daily charge for driving in central London (Monday–Friday, 7am–6pm)

- Impact: Traffic reduced by 30% in the first year; air quality improved; revenue funds public transport improvements

- Evaluation: Effective in reducing congestion, but regressive impact on low-income drivers; some businesses claim it harms trade

2. UK Sugar Tax (2018)

- Type: Negative consumption externality (obesity, diabetes, dental decay)

- Intervention: Soft Drinks Industry Levy—18p per litre for drinks with 5–8g sugar per 100ml; 24p per litre for drinks with over 8g sugar per 100ml

- Impact: Many manufacturers reformulated products to avoid the tax; consumption of high-sugar drinks fell

- Evaluation: Successful in changing producer behaviour, but demand for sugary drinks is relatively inelastic, limiting impact on consumption

3. UK Plastic Bag Charge (2015)

- Type: Negative consumption externality (plastic pollution, harm to marine life)

- Intervention: 5p charge per single-use plastic bag (increased to 10p in 2021)

- Impact: Plastic bag use fell by over 95% in major supermarkets

- Evaluation: Highly effective and low-cost intervention; minimal impact on consumers; revenue donated to environmental charities

4. Renewable Energy Subsidies (Feed-in Tariffs, 2010–2019)

- Type: Positive production externality (reduced carbon emissions, energy security)

- Intervention: Payments to households and businesses generating renewable electricity (e.g., solar panels)

- Impact: Significant increase in renewable energy capacity; UK solar capacity grew from 95 MW in 2010 to over 13,000 MW by 2019

- Evaluation: Expensive for taxpayers; some argue subsidies benefited wealthy homeowners more than low-income households; scheme closed in 2019

5. UK Smoking Ban (2007)

- Type: Negative consumption externality (secondhand smoke, health risks)

- Intervention: Prohibition of smoking in enclosed public spaces and workplaces

- Impact: Immediate reduction in secondhand smoke exposure; hospital admissions for heart attacks fell by 2.4% in the first year

- Evaluation: Highly effective regulation with strong public support; no ongoing cost to government; some pubs and clubs reported reduced trade

Exam Technique and Command Words

Time Allocation

Edexcel GCSE Economics exams allocate approximately 1 minute per mark, plus additional time for reading and planning. For a 12-mark question, aim to spend 12–15 minutes writing your answer.

Command Word Strategies

Define (1–2 marks)

- Provide a precise definition.

- Example: "An externality is a cost or benefit experienced by a third party not involved in the production or consumption of a good or service."

Explain (4–6 marks)

- Provide a clear explanation with supporting detail.

- Use the Chain of Analysis technique: Cause → Effect → Further Effect → Link to question.

- Example: "A carbon tax increases the cost of fossil fuels → firms pass this cost onto consumers through higher prices → demand for fossil fuels falls → carbon emissions decrease → the negative externality is reduced."

Analyse (6–8 marks)

- Break down the issue and explore relationships.

- Use economic terminology and diagrams where appropriate.

- Consider both short-term and long-term effects.

Evaluate (8–12 marks)

- Present a balanced argument with evidence on both sides.

- Consider factors such as price elasticity, opportunity cost, government failure, and distributional effects.

- Reach a supported judgement: "Overall, taxation is likely to be effective in reducing negative externalities if demand is price elastic, but less effective if demand is inelastic, as seen with cigarettes."

Common Pitfalls

- Confusing social cost with external cost: Social cost = Private cost + External cost. Do not use these terms interchangeably.

- Describing impacts on consumers or producers instead of third parties: Externalities affect third parties by definition.

- Asserting that government intervention always works: Consider government failure, unintended consequences, and opportunity costs.

- Providing generic answers without context: Apply your knowledge to the specific example in the question (e.g., London congestion charge, sugar tax).

- Ignoring price elasticity of demand: The effectiveness of taxation depends heavily on whether demand is elastic or inelastic.

Second-Order Economic Thinking

Causation

Externalities arise because of the absence of property rights and the non-excludability of certain costs and benefits. When no one owns clean air or a quiet neighbourhood, individuals and firms do not bear the full cost of polluting or creating noise. This leads to overconsumption and overproduction of goods with negative externalities.

Consequence

The consequences of externalities include:

- Allocative inefficiency: Resources are not allocated to maximise social welfare.

- Welfare loss: Society experiences a deadweight loss because the market quantity differs from the socially optimal quantity.

- Equity concerns: Negative externalities often disproportionately affect low-income communities (e.g., pollution in industrial areas).

- Need for government intervention: Externalities provide a key justification for state intervention in markets.

Change and Continuity

Historically, awareness of externalities has grown alongside environmental concerns and public health campaigns. The UK has introduced increasingly stringent regulations and taxes to address pollution, smoking, and unhealthy consumption. However, debates continue over the appropriate level of intervention and the balance between individual freedom and collective welfare.

Significance

Externalities are significant because they:

- Explain a major form of market failure.

- Justify government intervention in markets.

- Link to contemporary policy debates on climate change, public health, and urban planning.

- Appear across multiple areas of the Edexcel specification, including market failure, government intervention, and welfare economics.