Study Notes

Overview

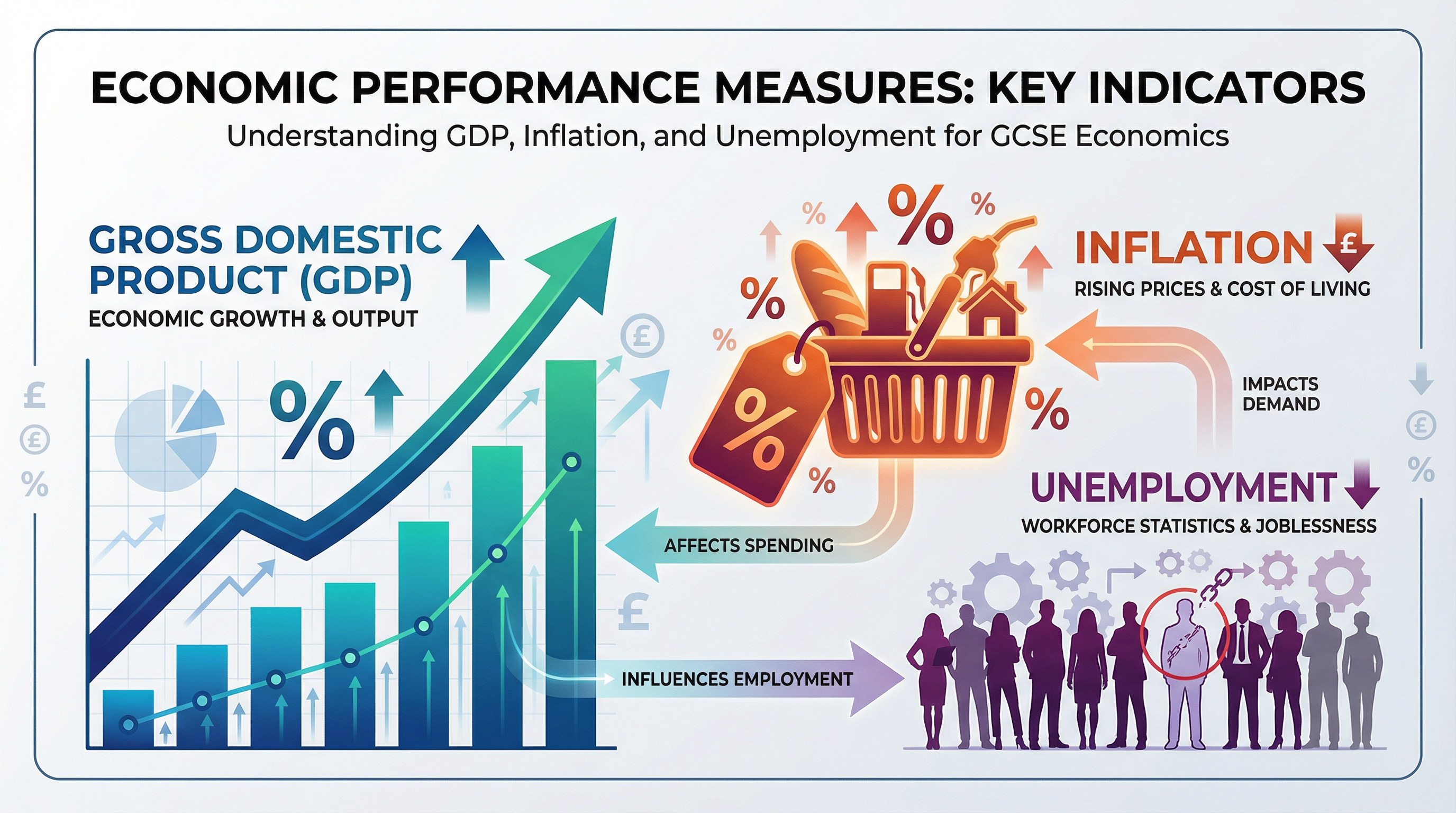

Measures of Economic Performance sits at the heart of macroeconomics and forms the foundation for understanding government policy objectives. This topic requires candidates to demonstrate both technical precision in calculating economic indicators and analytical depth in evaluating their limitations as measures of economic welfare. The OCR J205 specification demands that you can distinguish between different measurement methods (such as Real versus Nominal GDP, or Claimant Count versus Labour Force Survey), explain the interrelationships between the three key indicators, and assess the trade-offs governments face when pursuing conflicting objectives. Examiners consistently award the highest marks to responses that use specific data from case studies, employ precise economic terminology, and construct developed chains of reasoning using the Because-Leading to-Therefore (BLT) structure. Success in this topic requires mastery of calculation techniques, understanding of the consequences of changes in each indicator, and the ability to evaluate which measure matters most in different economic contexts.

Key Concepts & Definitions

Gross Domestic Product (GDP)

Definition: GDP is the total value of all goods and services produced within a country's borders over a specific time period, typically measured annually or quarterly.

GDP serves as the primary measure of economic growth and the size of an economy. Candidates must understand that there are three equivalent methods of calculating GDP, each providing the same final figure. The Output Method sums the value of all goods and services produced across primary, secondary, and tertiary sectors. The Income Method aggregates all factor incomes: wages paid to workers, profits earned by businesses, rent received by property owners, and interest paid to lenders. The Expenditure Method uses the formula GDP = C + I + G + (X - M), where C represents consumer spending, I represents business investment, G represents government spending, X represents exports, and M represents imports.

The critical distinction candidates must make is between Nominal GDP and Real GDP. Nominal GDP measures output at current prices without adjusting for inflation, meaning an apparent increase might simply reflect rising prices rather than genuine growth in production. Real GDP adjusts for inflation by using constant prices from a base year, revealing the true change in output volume. For example, if Nominal GDP grows by 5% but inflation is 3%, Real GDP growth is only 2%. Examiners frequently test this distinction, and responses that fail to specify "Real" when discussing living standards or economic growth lose marks.

GDP per capita divides total GDP by the population, providing a measure of average income per person. This is a better indicator of living standards than total GDP, as a country with high GDP but massive population may have lower living standards than a smaller, wealthier nation.

Specific Knowledge for Exams: UK GDP in 2025 is approximately £2.5 trillion. The UK experienced negative GDP growth during the 2008 financial crisis (approximately -4.2% in 2009) and during the COVID-19 pandemic (approximately -9.3% in 2020). China's GDP is around $18 trillion, making it the world's second-largest economy after the USA.

Inflation

Definition: Inflation is a sustained increase in the general price level of goods and services over time, resulting in a fall in the purchasing power of money.

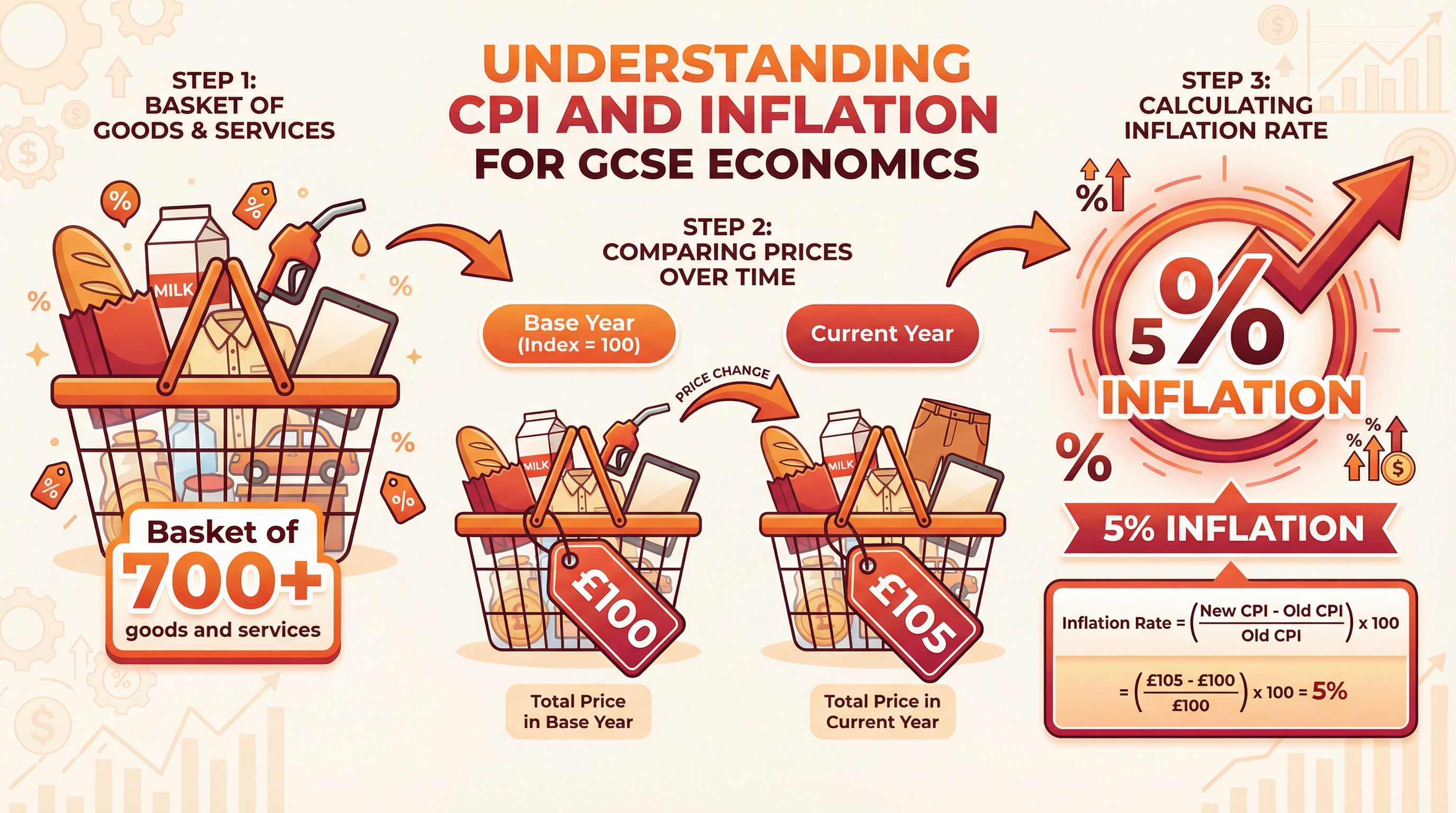

The key words here are "sustained" and "general" - a one-off price spike in a single product is not inflation. Candidates must distinguish between inflation (rising prices), disinflation (prices still rising but at a slower rate), and deflation (falling prices). The UK measures inflation primarily using the Consumer Price Index (CPI), which tracks the price changes of a basket of over 700 goods and services weighted according to typical household spending patterns.

The CPI calculation involves selecting a base year (set at index 100) and comparing current prices to that baseline. If the CPI rises from 100 to 105, this represents 5% inflation. The inflation rate formula is:

Inflation Rate = ((New CPI - Old CPI) / Old CPI) × 100For example, if CPI was 108.5 in January 2025 and 111.4 in January 2026:

Inflation Rate = ((111.4 - 108.5) / 108.5) × 100 = 2.67%

Candidates must always show this working in exam calculations to secure full method marks even if the final answer is incorrect.

The causes of inflation include demand-pull inflation (excessive consumer demand exceeding supply, often due to low interest rates or high consumer confidence) and cost-push inflation (rising production costs such as wages, raw materials, or energy prices forcing businesses to increase prices). The consequences of high inflation include reduced purchasing power for consumers (particularly harming those on fixed incomes), uncertainty for businesses (making long-term investment decisions difficult), loss of international competitiveness (if UK inflation exceeds that of trading partners), and menu costs (the expense of constantly updating prices).

The UK government's inflation target, set by the Bank of England, is 2% CPI. This low, stable rate is considered optimal as it avoids the problems of high inflation while preventing deflation (which can cause consumers to delay purchases, reducing demand and causing recession).

Specific Knowledge for Exams: UK inflation peaked at over 11% in October 2022 due to energy price shocks following the Russia-Ukraine conflict. The Bank of England's Monetary Policy Committee uses interest rates as the primary tool to control inflation. Hyperinflation in Zimbabwe (2008) reached 89.7 sextillion percent, rendering the currency worthless.

Unemployment

Definition: Unemployment measures the number of people of working age who are actively seeking employment but are unable to find work.

The crucial phrase is "actively seeking" - individuals not looking for work are classified as economically inactive (such as students, retirees, or stay-at-home parents) rather than unemployed. The UK uses two main measurement methods. The Claimant Count records those claiming unemployment-related benefits (Jobseeker's Allowance and Universal Credit). This data is easy to collect monthly but underestimates true unemployment as not all jobless people claim benefits (due to eligibility criteria or stigma). The Labour Force Survey (LFS) uses the International Labour Organization (ILO) definition, surveying 40,000 households and counting anyone who has looked for work in the past four weeks and is available to start within two weeks. This provides a more comprehensive measure but is more expensive and time-consuming to collect.

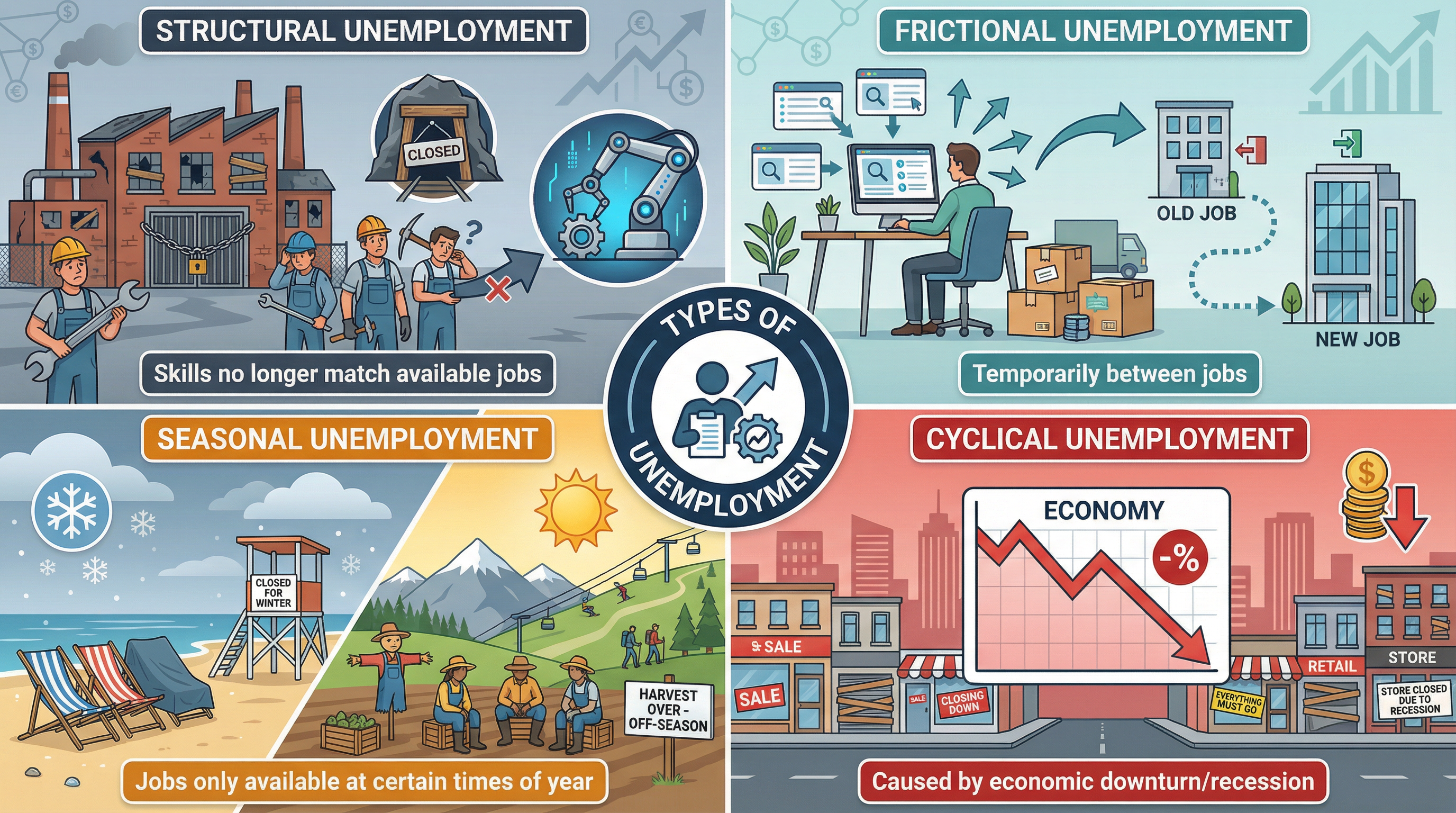

Candidates must know four types of unemployment:

-

Structural Unemployment: Occurs when workers' skills no longer match available jobs, often due to declining industries (e.g., coal mining in the UK) or technological change (automation replacing manual workers). This is long-term and geographically concentrated, requiring retraining programs to resolve.

-

Frictional Unemployment: Short-term unemployment as people move between jobs. This is natural and healthy in a dynamic economy, typically lasting a few weeks or months. It can be reduced by improving job information (online job sites) and reducing barriers to mobility.

-

Seasonal Unemployment: Jobs that only exist at certain times of year, such as tourism (summer), agriculture (harvest periods), or retail (Christmas). Workers may claim benefits during off-seasons or find temporary alternative employment.

-

Cyclical Unemployment: Caused by insufficient demand during economic recession. When GDP falls, businesses reduce output and lay off workers. This is the most serious type as it affects all sectors simultaneously and can only be resolved by economic recovery.

The consequences of unemployment include lost output for the economy (unemployed workers produce nothing, reducing GDP), increased government spending (unemployment benefits, housing support), reduced tax revenue (no income tax from unemployed workers, less VAT from reduced spending), personal costs (poverty, mental health problems, loss of skills), and social costs (increased crime, family breakdown).

Specific Knowledge for Exams: UK unemployment rate in 2025 is approximately 4.2%. Youth unemployment (16-24 age group) is typically double the overall rate. The UK's lowest unemployment rate was 3.4% in 2022. During the 1980s recession, UK unemployment exceeded 3 million (over 10%).

Interrelationships Between Indicators

Understanding how GDP, inflation, and unemployment interact is essential for evaluation questions. Economic growth (rising GDP) typically reduces unemployment as businesses expand and hire more workers, but may cause demand-pull inflation if growth is too rapid. The Phillips Curve suggests an inverse relationship between unemployment and inflation - when unemployment falls, wages rise (due to labor scarcity), pushing up costs and prices. Conversely, reducing inflation through high interest rates may slow economic growth and increase unemployment.

Governments face trade-offs between objectives. Policies to reduce unemployment (such as cutting interest rates to boost spending) may increase inflation. Policies to control inflation (raising interest rates) may cause unemployment to rise. This conflict means governments must prioritize objectives based on current economic conditions. Candidates who recognize and explain these trade-offs in evaluation questions demonstrate higher-order thinking that examiners reward with top-level marks.

Limitations of Economic Indicators

Candidates must be able to evaluate the limitations of each measure:

GDP Limitations:

- Ignores the informal economy (cash-in-hand work, subsistence farming, household production)

- Fails to account for quality of life factors (leisure time, environmental quality, health, happiness)

- Does not measure income distribution - GDP may rise while inequality worsens

- Includes "bads" as well as goods (e.g., spending on crime prevention or pollution cleanup increases GDP)

- Ignores sustainability - GDP can grow by depleting natural resources

Inflation Limitations:

- CPI basket may not reflect individual spending patterns (pensioners spend more on heating, students on rent)

- Struggles to account for quality improvements (a £500 smartphone today is far superior to one from 2010)

- Different households experience different inflation rates depending on their consumption

- Excludes housing costs (mortgage interest payments)

Unemployment Limitations:

- Ignores underemployment (part-time workers wanting full-time hours, graduates in low-skilled jobs)

- Claimant Count excludes those ineligible for benefits

- Does not measure quality of employment (zero-hours contracts, low wages)

- Regional variations are masked by national averages

Listen to the 10-minute study podcast above for a comprehensive audio revision of this topic, including exam tips, common mistakes, and a quick-fire quiz to test your knowledge.

Government Policy Objectives

The UK government pursues four main macroeconomic objectives:

- Economic Growth: Sustained increase in Real GDP, typically targeting 2-3% annual growth

- Low Unemployment: Aiming for around 4% unemployment (some frictional unemployment is unavoidable)

- Low and Stable Inflation: 2% CPI target set by the Bank of England

- Balance of Payments Equilibrium: Exports roughly equal to imports (not covered in detail in this topic)

Policies to achieve these objectives include monetary policy (Bank of England adjusting interest rates to control inflation and influence growth) and fiscal policy (government changing taxation and spending to manage demand). Candidates should understand that these policies have time lags, unintended consequences, and may conflict with each other.

Exam Application: Using Data Effectively

OCR examiners emphasize that AO2 (Application) marks require explicit use of case study data. Generic statements like "unemployment increased" score zero application marks. Instead, write: "Unemployment rose from 4.2% in 2023 to 5.8% in 2024, an increase of 1.6 percentage points." This demonstrates you have engaged with the specific evidence provided.

When analyzing consequences, use the BLT structure:

- Because: State the initial change

- Leading to: Explain the mechanism

- Therefore: State the final consequence

Example: "Rising inflation reduces consumer purchasing power BECAUSE the same income buys fewer goods and services, LEADING TO reduced consumer spending, THEREFORE causing lower demand for businesses and potentially triggering cyclical unemployment."

This structured approach ensures your analysis is developed and logical, securing higher-level marks.